green insurance

business consultancy, business growth, business optimization, business solutions, business strategy, change management, client relationships, consultancy skills, consultancy work, consultant services, consulting services., cost-effective solutions, digital transformation, environmental consultancy, expert advice, financial consultancy, HR consultancy, industry expertise, leadership consulting, legal consultancy, management consulting, market analysis, marketing consultancy, operational efficiency, organizational performance, problem-solving, process improvement, professional advice, project management, startup consultancy, strategic planning, technology consultancy

mahainsurance

0 Comments

Why Solar Panel Insurance Is A Must Have For Homeowners In 2025

As the world pivots towards clean energy, solar panels have become a cornerstone of sustainable living. By harnessing the power of the sun, homeowners reduce energy bills, decrease their carbon footprint, and gain independence from volatile energy markets. However, like any investment, solar panels come with risks, including weather damage, theft, and technical malfunctions. Solar panel insurance offers a reliable safety net, making it indispensable for homeowners in 2025.

In recent years, solar energy has emerged as a game-changer in the global fight against climate change. As more homeowners adopt solar panels to reduce their carbon footprint and save on electricity costs, it’s crucial not to overlook the importance of protecting this valuable investment. Solar panel insurance is a specific type of coverage designed to protect solar energy systems from various risks, such as weather-related damage, theft, technical malfunctions, and more. With the increasing number of homeowners making the switch to solar energy, solar panel insurance is becoming a must-have in 2025.

Key Takeaways

- Solar panel insurance protects against weather damage, theft, technical failures, and more.

- Tailored policies ensure comprehensive coverage for green energy systems.

- Incentives, such as tax credits and discounts, reduce overall costs.

- Examples and case studies show the tangible benefits of having solar panel insurance.

- Proper evaluation of risks and coverage options is crucial for selecting the right policy.

What Is Solar Panel Insurance?

Solar panel insurance provides financial protection against damage to or loss of solar panels and related equipment. It covers the cost of repairing or replacing damaged components such as the solar panels, inverters, wiring, and mounting systems. This type of insurance typically covers natural events, accidents, and sometimes even the loss of energy production due to system failure. Whether you’re installing a new solar system or already have one in place, solar panel insurance ensures that you don’t face significant out-of-pocket expenses in the event of damage or loss.

Why Is Solar Panel Insurance Important?

Solar panels are a significant investment, with costs often reaching several thousand dollars. Without insurance, homeowners are at risk of bearing the full cost of repairs or replacement if their system is damaged or experiences failure. Solar panel insurance is essential for several reasons:

- Protection Against Weather-Related Damage

Solar panels are exposed to the elements, making them vulnerable to weather-related risks like hail, snow, and strong winds. A severe storm can cause significant damage, and without insurance, homeowners may have to bear the full cost of replacing damaged panels or components. - Coverage for Theft and Vandalism

Solar panels are valuable, and they are often targeted by thieves. In some cases, solar panels are also damaged by vandals. Insurance ensures that you are reimbursed for any stolen or vandalized equipment. - Malfunctions and Technical Failures

Solar systems rely on multiple components working together, such as inverters, panels, wiring, and batteries. If any of these components malfunction or fail, it could render the entire system ineffective. Solar panel insurance can help cover the cost of repairs or replacements for faulty parts. - Fire Damage

Electrical fires, whether caused by faulty wiring or external factors, can result in significant damage to solar systems. Insurance protects homeowners from financial losses due to fires affecting their solar panels or related systems.

Types of Solar Panel Insurance Coverage

Solar panel insurance can vary depending on the provider and policy, but there are several common coverage types:

| Coverage Type | Explanation | Example |

|---|---|---|

| Weather Damage | Covers damage from extreme weather conditions, including hail, wind, snow, and storms. | A hailstorm damages multiple solar panels, which are replaced by the insurer. |

| Theft and Vandalism | Covers the cost of replacing stolen or vandalized panels. | Solar panels are stolen from a rooftop; insurance compensates for the full replacement cost. |

| Fire Damage | Protects against damage from fires, whether due to faulty wiring or external factors like wildfires. | A fire ignited by electrical malfunction destroys the solar panels; insurance covers repairs. |

| Malfunctioning Inverter | Covers repairs or replacements for malfunctioning inverters that convert solar energy into electricity. | An inverter fails, stopping energy production; insurance reimburses the cost of repairs. |

| Loss of Energy Production | Covers lost income due to the inability to generate power from damaged systems, especially in feed-in tariff setups. | A system failure reduces power production, resulting in lost income from solar energy sales. |

Solar panels are a significant investment, and to protect that investment, it’s essential to have the right insurance coverage in place. Solar panel insurance ensures that you are financially protected against damage, theft, and system failure. Below are the common types of solar panel insurance coverage that homeowners can consider:

1. Weather Damage Coverage

Description:

This type of coverage protects solar panels against damage caused by severe weather events such as hail, heavy snow, strong winds, or lightning. Since solar panels are exposed to the elements year-round, they are vulnerable to extreme weather conditions that can cause physical damage, rendering them inefficient or even completely unusable.

What it covers:

- Hail damage: Hailstones can crack or shatter panels.

- Wind damage: High winds can dislodge or break panels.

- Snow and ice damage: Accumulation of snow and ice can cause panels to crack or become dislodged.

- Lightning strikes: A lightning strike can cause electrical damage to solar panels or the inverter.

Example:

A homeowner’s solar panel system is damaged by a severe hailstorm, which shatters several of the panels. Weather damage coverage will cover the costs of repairing or replacing the panels.

2. Theft and Vandalism Coverage

Description:

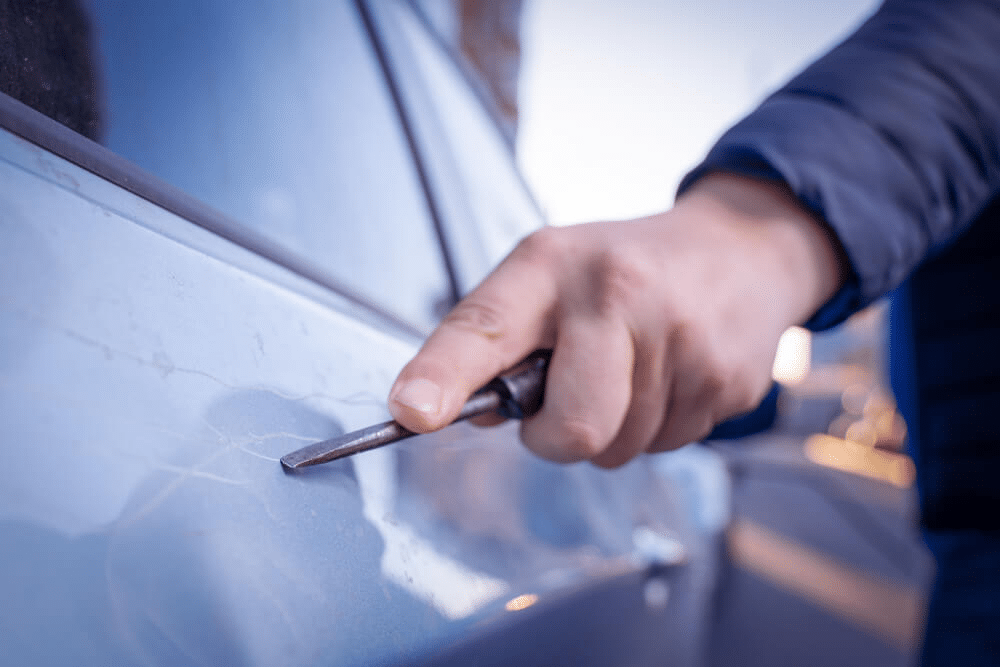

Solar panels are valuable assets and are often targeted by thieves or vandals. Theft and vandalism coverage helps protect homeowners in the unfortunate event that their solar panels are stolen or damaged intentionally.

What it covers:

- Stolen solar panels: If the solar panels are stolen from the property, the insurance will reimburse the homeowner for the value of the panels.

- Vandalism damage: This includes deliberate acts of damage, such as breaking the panels or defacing the equipment.

Example:

A homeowner finds that their solar panels have been stolen from their roof. Theft coverage will reimburse the homeowner for the stolen equipment’s value, and they can use that amount to replace the panels.

3. Fire Damage Coverage

Description:

Solar systems, like any electrical system, pose a potential fire risk due to issues like faulty wiring or electrical malfunctions. Fire damage coverage ensures that homeowners are protected in case their solar panels or the electrical components of the system cause or suffer damage from a fire.

What it covers:

- Electrical fires: If an electrical short-circuit or malfunction in the solar system causes a fire that damages the panels or surrounding property.

- Fire from external sources: Fires from nearby properties or wildfires that spread and damage the solar system.

Example:

A fire starts due to faulty wiring in the solar inverter, and the fire spreads to the roof. Fire damage coverage will pay for the repair or replacement of the panels and any related property damage caused by the fire.

4. Malfunctioning or Defective Equipment Coverage

Description:

Sometimes, solar systems suffer from internal issues due to defective components or malfunctions that are not caused by weather or external factors. This coverage ensures that your insurance policy will cover the cost of repairing or replacing defective parts like inverters, wiring, or other equipment that are crucial to the solar system’s operation.

What it covers:

- Defective solar panels: Panels that fail due to manufacturing defects.

- Faulty inverters: Inverters convert solar power into usable electricity; if they stop working, the whole system could fail.

- Wiring issues: Problems with wiring that prevent the system from functioning properly.

Example:

A solar inverter breaks down after a few years of use due to a manufacturing defect. Malfunctioning equipment coverage will cover the cost of replacing the faulty inverter.

5. Loss of Energy Production Coverage

Description:

This coverage is particularly important for homeowners who sell excess energy back to the grid through a feed-in tariff or net metering system. If the solar panels stop producing energy due to damage or failure, this coverage ensures that homeowners are compensated for the lost income from their energy production.

What it covers:

- Loss of power generation: If the panels or the inverter fail to produce electricity due to damage, this coverage compensates for the lost production.

- Income loss: For homes that earn money from generating and selling solar power to the grid, this coverage ensures that income is replaced until the system is repaired or replaced.

Example:

A solar system suffers a major malfunction, and the panels stop generating electricity for several weeks. Loss of energy production coverage will compensate the homeowner for the income lost during the downtime.

6. Liability Coverage

Description:

Liability coverage protects homeowners in case their solar panels cause injury or damage to others. This is particularly important if the installation or equipment failure results in injury or damage to property outside of the homeowner’s own residence.

What it covers:

- Injury to others: If a panel falls off the roof and injures someone, the homeowner is covered for medical expenses or legal liabilities.

- Damage to neighboring property: If solar panels or mounting structures damage a neighbor’s property, the homeowner’s liability coverage will pay for repairs or damages.

Example:

A solar panel falls from the roof during a windstorm and hits a neighbor’s car, causing significant damage. Liability coverage will cover the cost of repairing the vehicle or paying for legal claims if the neighbor sues.

7. General Property Damage Coverage

Description:

This coverage ensures that the surrounding property (such as the roof or house structure) is protected in the event of a solar panel malfunction or accident. For example, if a panel is damaged and causes additional damage to the home, this coverage will help pay for repairs to the property.

What it covers:

- Roof damage: If solar panels are installed on the roof, and they cause structural damage due to a malfunction or improper installation.

- Additional damage to home structures: In some cases, solar panel failure or malfunction could result in damage to the home’s structural components.

Example:

A faulty solar panel causes water leakage, which damages the roof and the home’s interior. General property damage coverage will help with the repair costs.

Comparing Coverage Options:

| Coverage Type | Protects Against | Example |

|---|---|---|

| Weather Damage | Hail, snow, wind, lightning | Damage to panels after a hailstorm |

| Theft and Vandalism | Theft, intentional damage | Stolen solar panels |

| Fire Damage | Fire from electrical malfunction or external sources | Fire started by faulty wiring or wildfire damage |

| Malfunctioning Equipment | Failure of solar panels, inverters, wiring, etc. | Broken inverter or defective solar panel |

| Loss of Energy Production | Loss of solar energy generation | Inoperable solar system during the summer |

| Liability Coverage | Injury or property damage caused by solar panels | Panel falls and injures a neighbor |

| General Property Damage | Damage to home or property caused by solar panel failure | Roof and house damage caused by solar panel issue |

What Does Solar Panel Insurance Cover?

Most solar panel insurance policies cover the following:

- Physical damage to the panels: If your solar panels are damaged by weather conditions, accidents, or vandalism, insurance will cover the cost of repairs or replacements.

- Fire damage: Damage to your system caused by a fire, whether from an external source or an electrical issue, is covered under most policies.

- Malfunctions or defects: If your system stops working due to component failure, such as a faulty inverter, insurance can cover the cost of repairs or replacements.

- Liability protection: If your solar system causes injury or damage to others, liability coverage may help protect you from lawsuits or claims.

- Loss of energy production: Some policies also cover lost energy production due to system failures or damage. This is especially useful for homeowners who sell excess energy back to the grid.

How to Choose the Right Solar Panel Insurance Policy?

When shopping for solar panel insurance, there are several factors to consider to ensure that you’re getting the right coverage for your needs:

- Coverage Limits

Ensure that the insurance policy covers the full value of your solar panels and associated equipment. This includes both the cost of repairs and replacements. - Deductible

The deductible is the amount you must pay out of pocket before the insurance kicks in. A higher deductible can reduce your premiums, but make sure it’s still affordable in the event of a claim. - Exclusions

Read the fine print to ensure there are no exclusions or limitations that could leave you vulnerable to specific risks, such as damage caused by poor maintenance or wear and tear. - Claims Process

Understand how the insurance provider handles claims. Ideally, the process should be straightforward, with minimal delays. - Policy Duration and Renewals

Check how long the policy lasts and whether it can be renewed annually. Most solar panel insurance policies are renewable on a yearly basis.

Cost of Solar Panel Insurance

The cost of solar panel insurance depends on various factors, including the value of your system, the level of coverage, and the location of your home. On average, homeowners can expect to pay between $100 and $500 per year for solar panel insurance.

| Factor | Impact on Cost |

|---|---|

| System Size | Larger systems with more panels incur higher premiums. |

| Location | Homes in storm-prone or high-theft areas typically pay higher premiums. |

| Type of Coverage | Comprehensive coverage, including weather, theft, and fire, will increase premiums. |

| Deductible | A higher deductible lowers premiums but increases out-of-pocket costs during claims. |

| Add-ons and Riders | Customizing your policy with additional coverage options will increase costs. |

Benefits of Solar Panel Insurance

- Peace of Mind: Knowing that your solar system is covered allows you to enjoy the benefits of solar energy without worrying about unexpected costs from damage or failure.

- Financial Protection: Solar panel repairs or replacements can be costly. Insurance helps mitigate these expenses, ensuring that you’re not left with a hefty bill.

- Long-Term Savings: While solar panels are an investment upfront, insurance ensures that you’re protected in the long term, allowing you to enjoy uninterrupted energy savings.

- Increased Property Value: Having solar panels with comprehensive insurance can increase the appeal of your property, as prospective buyers will feel more confident knowing the system is covered.

The Growing Popularity of Solar Panels

The adoption of solar panels is soaring due to:

- Cost Savings: Significant reductions in electricity bills.

- Government Incentives: Tax credits and subsidies for solar installation.

- Environmental Impact: A reduction in greenhouse gas emissions.

- Energy Independence: Freedom from grid reliance and rising utility costs.

Statistics Highlighting Solar Growth

| Metric | 2020 | 2025 (Projected) |

|---|---|---|

| Global Solar Capacity (GW) | 707 GW | 1,500+ GW |

| Solar Installations (US Homes) | 2.7 million | 5+ million |

| Average Installation Cost (US) | $15,000 | $12,000 (reduced) |

Why Solar Panel Insurance Is Essential

1. Protecting Your Investment

Solar panels are a significant financial investment, with installation costs ranging from $10,000 to $30,000. Without insurance, repairing or replacing damaged panels could cost thousands of dollars.

2. Coverage for Unpredictable Weather

Extreme weather events like hurricanes, hailstorms, and heavy snow can damage panels. Insurance provides peace of mind against climate-related risks.

3. Safeguarding Against Theft and Vandalism

Solar panels, being valuable assets, are vulnerable to theft or vandalism, particularly in remote areas. Insurance covers replacement and repair costs.

4. Shielding Against Technical Failures

Inverters, wiring, and other components can malfunction. Insurance ensures prompt repairs or replacements, minimizing downtime.

5. Compliance with Solar Loans or Leasing Agreements

Homeowners financing their solar systems may be required to have insurance by lenders or leasing companies.

What Does Solar Panel Insurance Typically Cover?

| Coverage | Details | Example |

|---|---|---|

| Weather Damage | Protects against hail, wind, snow, lightning, and more. | A hailstorm cracks several panels; insurance covers replacements. |

| Fire Damage | Covers damage from electrical fires or external sources. | An electrical fire damages the system. |

| Theft and Vandalism | Replacement of stolen or vandalized panels. | Panels stolen from a rural property are fully covered. |

| Technical Failures | Coverage for inverter malfunctions, wiring issues, etc. | A defective inverter is replaced under the policy. |

| Natural Disasters | Coverage for earthquakes, hurricanes, and floods (may require add-ons). | Solar panels damaged in a hurricane are replaced. |

| Business Interruption | For homeowners selling surplus energy; compensates for downtime. | Lost income due to damaged panels halting energy production. |

Examples of Solar Panel Insurance in Action

Example 1: Weather Damage

A homeowner in Texas faces a severe hailstorm that cracks three solar panels. Without insurance, they face a $3,000 repair bill. With insurance, the repairs are fully covered.

Example 2: Theft

In California, a homeowner’s rooftop solar panels are stolen. The replacement cost of $8,000 is reimbursed under their insurance policy.

Example 3: Technical Malfunction

A faulty inverter stops a system from functioning. Insurance covers the $1,500 cost of replacement, ensuring minimal disruption.

Cost of Solar Panel Insurance

| Factor | Impact on Cost |

|---|---|

| System Value | Higher costs for more expensive installations. |

| Location | Areas prone to extreme weather have higher premiums. |

| Type of Coverage | Comprehensive policies cost more than basic ones. |

| Deductible Amount | Higher deductibles lower premiums. |

| Additional Riders | Add-ons like earthquake or flood coverage increase costs. |

Average Cost in 2025

- Basic Coverage: $100–$300 annually.

- Comprehensive Coverage: $400–$800 annually.

Factors to Consider When Choosing Solar Panel Insurance

- Type of Coverage Needed

- Assess risks specific to your location (e.g., hurricanes, theft).

- Policy Exclusions

- Check for exclusions like general wear and tear or cosmetic damage.

- Claim Process

- Ensure the insurance company has a smooth and efficient claims process.

- Reputation of the Insurer

- Opt for providers with experience in renewable energy insurance.

- Customizable Add-Ons

- Consider riders for unique risks, like business interruption for homeowners selling energy.

Also Read: Why Eco Insurance Is The Smart Choice For Green

Conclusion

Solar panel insurance is an essential safeguard for homeowners in 2025. As renewable energy adoption grows, protecting these valuable systems from risks like weather damage, theft, and technical failures becomes crucial. By investing in solar panel insurance, homeowners can enjoy financial security, peace of mind, and uninterrupted green energy production.

FAQs

1. Is solar panel insurance separate from homeowners insurance?

In most cases, solar panels are covered under homeowners insurance, but specific solar panel insurance provides more tailored protection.

2. Does solar panel insurance cover maintenance?

No, routine maintenance is typically not covered. Policies focus on damage and unforeseen risks.

3. Are off-grid solar panels insurable?

Yes, off-grid systems can be insured, but the policy may vary depending on location and setup.

4. What is excluded from solar panel insurance?

Common exclusions include wear and tear, cosmetic damage, and improper installation.

5. Does insurance cover energy production losses?

Some policies offer business interruption coverage, compensating for lost income from energy production halts.

6. Are portable solar panels covered?

Portable panels are often excluded, but some insurers may offer optional riders for them.

7. Can I bundle solar panel insurance with other policies?

Yes, many providers offer discounts for bundling solar panel insurance with homeowners or auto insurance.