Why Eco Insurance Is The Smart Choice For Green Minded Consumers

In the 21st century, environmental consciousness is no longer a niche ideology but a mainstream movement influencing industries worldwide. From renewable energy to sustainable fashion, businesses are rethinking traditional approaches to align with eco-friendly values. The insurance industry is no exception. Eco insurance is gaining traction as a viable and responsible choice for individuals and businesses committed to protecting both their financial interests and the environment.

This article explores why eco insurance is the ideal choice for eco-conscious consumers, covering its features, benefits, challenges, and long-term implications. We’ll also address common FAQs and provide actionable key takeaways.

Key Takeaways

- Eco insurance aligns with environmental values, making it ideal for green-minded individuals.

- Policyholders receive incentives for adopting eco-friendly practices, reducing costs.

- Specialized coverage ensures protection for green assets like EVs, solar panels, and energy-efficient homes.

- Businesses benefit from sustainability certifications and enhanced brand reputation.

- Eco insurance supports climate resilience, safeguarding against climate-induced risks.

- Despite challenges, the long-term benefits outweigh initial costs, making eco insurance a smart investment.

What Is Eco Insurance?

Eco insurance, also known as green insurance, refers to insurance policies designed with a focus on environmental sustainability. These policies often include incentives for reducing carbon footprints, support for renewable energy projects, and tailored coverage for environmentally friendly assets like electric vehicles (EVs), solar panels, or energy-efficient homes.

Unlike traditional insurance, eco insurance aligns with sustainable principles, offering a win-win solution for both consumers and the planet.

Why Is Eco Insurance Becoming Popular?

Several global trends have contributed to the growing popularity of eco insurance:

- Increased Environmental Awareness: Consumers are becoming more conscious of their impact on the planet and are seeking products that align with their values.

- Government Regulations: Many governments now mandate sustainability initiatives, encouraging companies to adopt green practices.

- Corporate Social Responsibility (CSR): Businesses are prioritizing CSR, and eco insurance supports their sustainability goals.

- Climate Change Risks: As climate-related disasters increase, consumers and businesses need coverage that addresses unique risks associated with environmental changes.

Top Reasons Why Eco Insurance is the Smart Choice for Green-Minded Consumers

1. Alignment with Eco-Conscious Values

For environmentally conscious individuals, traditional insurance policies may feel misaligned with their values. Eco insurance ensures their financial investments directly contribute to sustainable initiatives.

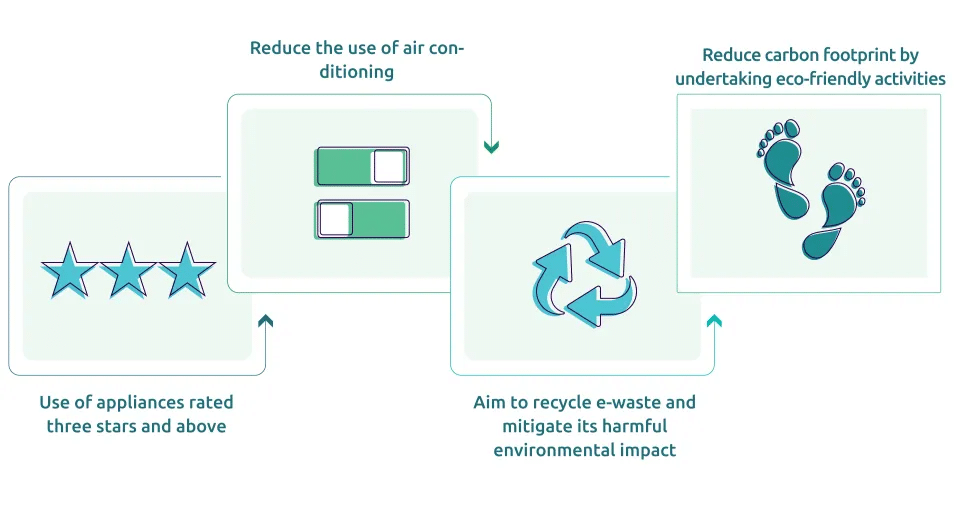

2. Encourages Green Behavior

Eco insurance providers often reward policyholders for adopting sustainable practices:

- Electric Vehicle Discounts: Reduced premiums for EV owners.

- Energy-Efficient Homes: Lower costs for homes with green certifications or energy-saving installations.

- Carbon Offsetting Programs: Policies that contribute a portion of premiums to carbon offset projects.

3. Comprehensive Coverage for Green Assets

Green assets such as solar panels, wind turbines, or eco-friendly buildings may not be adequately covered under traditional policies. Eco insurance provides tailored protection for these investments, ensuring they’re safeguarded against damage or loss.

4. Supports Renewable Energy Development

Eco insurance actively promotes renewable energy by offering specialized coverage for projects like solar farms, wind farms, or geothermal plants. By mitigating financial risks, these policies encourage innovation and investment in green technologies.

5. Financial Savings Through Incentives

While some eco insurance policies might have slightly higher premiums, the long-term savings often outweigh the initial costs. Examples include:

- Reduced energy bills due to green repairs.

- Discounts for adopting environmentally friendly practices.

- Government subsidies for businesses using renewable energy.

6. Climate Risk Protection

Climate change has led to an increase in natural disasters such as floods, wildfires, and hurricanes. Eco insurance provides enhanced coverage for these risks, ensuring policyholders are financially protected against environmental hazards.

7. Fosters Corporate Sustainability

For businesses, eco insurance offers:

- Risk Assessments: Identifying areas where sustainability can reduce operational risks.

- Sustainability Certifications: Boosting credibility with consumers and stakeholders.

- Customized Coverage: Tailored policies for renewable energy systems or eco-friendly infrastructure.

8. Carbon Neutral Operations by Insurers

Many eco insurance companies are leading by example, adopting carbon-neutral operations by investing in reforestation projects or renewable energy initiatives. Consumers can feel confident their premiums contribute to positive environmental outcomes.

9. Green Repair and Replacement Options

In the event of damage, eco insurance often prioritizes environmentally friendly repair or replacement options. For example:

- Using recycled materials for property repairs.

- Replacing damaged vehicles with hybrid or electric models.

10. Boosts Climate Resilience

Eco insurance policies are designed to help individuals and businesses prepare for climate-related challenges, ensuring they remain financially resilient in the face of environmental uncertainties.

Types of Eco Insurance Policies

- Green Auto Insurance:

Designed for electric or hybrid vehicle owners, offering:- Discounts on premiums.

- Coverage for charging stations.

- Specialized repair services for EVs.

- Sustainable Home Insurance:

Policies for eco-friendly homes may include:- Coverage for energy-efficient appliances.

- Discounts for homes with solar panels or rainwater harvesting systems.

- Green rebuilding options after damage.

- Renewable Energy Insurance:

Tailored for projects like solar farms, wind farms, and biomass plants, ensuring financial protection against operational risks. - Climate Risk Insurance:

Coverage for climate-induced risks such as floods, droughts, or wildfires, with emphasis on long-term sustainability.

Challenges in Eco Insurance Adoption

- Higher Initial Costs:

While eco insurance offers long-term savings, the upfront costs may deter some consumers. - Limited Availability:

Eco insurance is still emerging, with limited providers and coverage options in some regions. - Complex Policy Terms:

Understanding specialized eco insurance policies can be more challenging than traditional ones. - Consumer Awareness:

Many people remain unaware of eco insurance benefits or how to access these policies.

Why Eco Insurance Is The Smart Choice For Green-Minded Consumers

Eco insurance is rapidly emerging as the go-to choice for individuals and businesses prioritizing environmental sustainability. This innovative insurance model caters to green-minded consumers by aligning with eco-conscious values, offering tailored coverage for eco-friendly assets, and actively supporting global sustainability efforts.

In this article, we’ll explore the various dimensions of eco insurance, enriched with examples, data, and actionable insights.

What Makes Eco Insurance Unique?

Eco insurance distinguishes itself from traditional insurance through several standout features:

1. Proactive Environmental Support

Insurance premiums are often used to support environmental projects, such as reforestation, renewable energy development, and carbon offset programs.

2. Customized Policies for Green Assets

Specialized coverage ensures protection for renewable energy systems, electric vehicles, and sustainable infrastructure.

3. Green Lifestyle Rewards

Eco-conscious consumers are rewarded with premium discounts, additional coverage options, and other perks for adopting sustainable behaviors.

4. Focus on Climate Risk Mitigation

Eco insurance providers prioritize coverage for risks that are exacerbated by climate change, such as floods, hurricanes, and wildfires.

What Is Eco Insurance?

Eco insurance refers to insurance policies specifically designed to promote sustainable practices and protect environmentally friendly assets. It encompasses a wide range of coverage options, including green vehicles, energy-efficient homes, renewable energy projects, and climate-related risks.

Why Eco Insurance Matters in Today’s World

1. Climate Change Is Increasing Risks

Natural disasters, driven by climate change, are becoming more frequent and severe. Eco insurance provides specialized coverage for such risks, ensuring financial protection for individuals and businesses.

2. The Shift Toward Green Living

Modern consumers are making deliberate choices to reduce their carbon footprints, and eco insurance supports this lifestyle by incentivizing sustainable practices.

3. Global Push for Sustainability

Governments, corporations, and individuals are all part of the global movement toward sustainability, and eco insurance is a natural extension of this trend.

4. Environmental and Financial Synergy

Eco insurance offers a dual benefit: financial protection and environmental stewardship. This synergy makes it an attractive option for forward-thinking consumers.

Features of Eco Insurance

| Feature | Details | Example |

|---|---|---|

| Green Incentives | Discounts for owning eco-friendly assets or adopting sustainable practices. | Lower premiums for electric vehicle owners. |

| Coverage for Green Assets | Specialized policies for renewable energy installations and energy-efficient systems. | Coverage for rooftop solar panels or wind turbines. |

| Support for Carbon Offsetting | Contributions to carbon offset projects as part of the premium. | Insurers funding reforestation projects. |

| Climate Risk Protection | Coverage for disasters like floods, droughts, and wildfires. | Home insurance policies covering climate-induced damages. |

| Green Repair Options | Eco-friendly materials and methods used for repairs and replacements. | Using recycled materials for repairing damaged properties. |

| Support for Renewable Energy | Financial protection for renewable energy projects like solar farms and wind turbines. | A wind farm covered against operational and weather-related risks. |

Benefits of Eco Insurance

1. Aligns With Green Values

Eco insurance helps environmentally conscious consumers ensure their financial decisions align with their values.

2. Encourages Sustainable Practices

Insurance companies incentivize green behavior, such as adopting renewable energy or using electric vehicles.

3. Supports Innovation in Green Technology

By offering coverage for renewable energy projects, eco insurance fosters innovation in sustainable technologies.

4. Enhanced Financial Protection Against Climate Risks

Eco insurance policies include coverage for risks exacerbated by climate change, such as flooding or wildfires.

5. Cost Savings Through Incentives

Policyholders save money through premium discounts, green certifications, and energy efficiency.

Examples of Eco Insurance in Action

1. Homeowners Insurance with Solar Panel Coverage

- A homeowner with solar panels receives tailored coverage, ensuring the panels are protected against damage or theft.

- Premium discounts are offered for having an energy-efficient home.

2. Electric Vehicle (EV) Insurance

- An EV owner benefits from reduced premiums, coverage for charging stations, and green repair options.

- Example: Insurers like Tesla Insurance offer exclusive plans for Tesla EV owners.

3. Renewable Energy Project Insurance

- A solar farm is insured against operational risks and weather-related damages, ensuring uninterrupted energy production.

- Example: Policies offered by companies like AXA Climate for renewable energy ventures.

4. Business Insurance for Green Initiatives

- A company investing in sustainable practices is rewarded with lower premiums and customized coverage for eco-friendly infrastructure.

- Example: Large corporations like IKEA have partnered with eco insurers to reduce their carbon footprints.

Eco Insurance vs. Traditional Insurance

| Feature | Eco Insurance | Traditional Insurance |

|---|---|---|

| Environmental Focus | Actively promotes sustainability and green practices. | Focuses on financial protection without environmental incentives. |

| Green Asset Coverage | Covers eco-friendly assets like solar panels and EVs. | Limited or no coverage for renewable energy systems or green vehicles. |

| Incentives | Discounts for adopting eco-friendly behavior. | Rarely offers incentives for sustainability. |

| Carbon Offset Contributions | Part of premiums may fund environmental projects. | No direct contributions to environmental initiatives. |

| Green Repair Options | Prioritizes the use of sustainable materials and methods for repairs. | Standard repair options without eco-friendly considerations. |

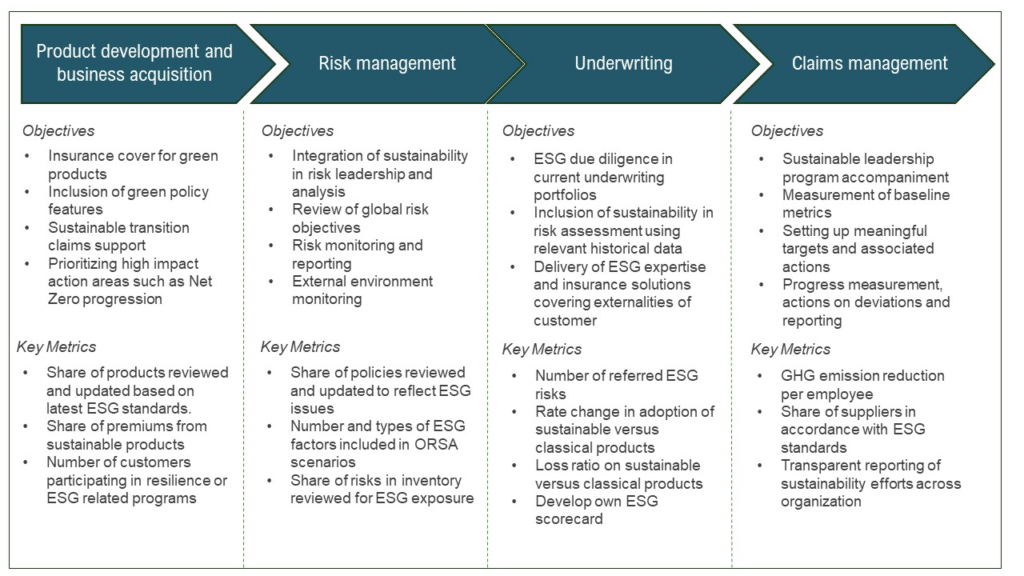

How Eco Insurance Supports Businesses

1. Risk Management for Green Operations

Eco insurance helps businesses mitigate risks associated with renewable energy projects, eco-friendly infrastructure, and sustainability programs.

2. Brand Reputation Boost

Businesses that adopt eco insurance signal their commitment to sustainability, enhancing their reputation among eco-conscious consumers.

3. Sustainability Certification Support

Many eco insurers offer guidance for obtaining green certifications, such as LEED (Leadership in Energy and Environmental Design).

4. Financial Protection for Climate Risks

Companies investing in green technology are better equipped to handle risks associated with climate change, such as floods or hurricanes.

Challenges in Adopting Eco Insurance

1. Higher Initial Costs

The initial premiums for eco insurance may be higher due to specialized coverage.

2. Limited Availability

Eco insurance is still emerging, and coverage options may be limited in certain regions.

3. Lack of Awareness

Many consumers are unaware of the benefits and availability of eco insurance.

4. Complex Policy Terms

Understanding eco insurance policies requires a deeper knowledge of sustainability concepts.

Key Features and Benefits of Eco Insurance

| Feature | Description | Example |

|---|---|---|

| Sustainable Premium Use | A portion of premiums funds green initiatives. | Funding solar-powered community projects or reforestation. |

| Eco Asset Protection | Coverage for environmentally friendly assets. | Policies covering electric vehicles, solar panels, and green-certified homes. |

| Disaster Preparedness | Protection against climate change-induced disasters. | Specialized flood insurance for coastal regions prone to rising sea levels. |

| Renewable Energy Support | Coverage for solar farms, wind turbines, and other renewable energy ventures. | Financial security for a wind farm against operational or natural risks. |

| Incentives for Green Choices | Rewards and discounts for using renewable energy, adopting green technology, or reducing carbon emissions. | Reduced premiums for energy-efficient homes. |

| Eco Repair and Rebuild Options | Encourages eco-friendly materials for repair and rebuilding after claims. | Using sustainable materials after property damage. |

Expanded Benefits of Eco Insurance

1. Green Asset-Specific Protection

- Homeowners with solar panels, wind turbines, or rainwater harvesting systems receive specialized coverage.

- Electric vehicle owners enjoy comprehensive insurance for their cars and charging stations.

2. Cost Savings and Tax Benefits

- Governments in some regions provide tax deductions or credits for adopting eco insurance policies.

- Premium discounts reduce overall costs for policyholders.

3. Corporate Sustainability Advantage

- Businesses gain a competitive edge by adopting eco insurance, which aligns with corporate social responsibility goals.

- Example: A company that insures its renewable energy projects enhances its green reputation while mitigating risks.

4. Incentives for Behavioral Change

- Eco insurance policies often come with rewards for behaviors like reducing energy consumption or carpooling.

- Example: A family that reduces their household energy usage by 20% receives a rebate on their premium.

5. Contribution to a Global Cause

- Policyholders indirectly contribute to global sustainability by supporting insurers’ investments in renewable energy and conservation.

6. Enhanced Resilience Against Climate Risks

- Regions prone to hurricanes, droughts, or wildfires benefit from tailored coverage that addresses these specific risks.

Practical Examples of Eco Insurance in Action

1. Sustainable Homeowners Insurance

A homeowner installs energy-efficient appliances and rooftop solar panels. Their eco insurance policy offers:

- Lower premiums.

- Additional coverage for green upgrades.

- Sustainable materials for repairs post-claim.

2. Business Insurance for Green Enterprises

A company transitioning to renewable energy insures its wind turbines against mechanical failure and weather damage. Benefits include:

- Protection against revenue loss due to downtime.

- Premium discounts for adopting carbon-neutral practices.

3. Electric Vehicle Insurance

An EV owner receives:

- Comprehensive coverage for vehicle and charging station.

- Incentives for participating in carpool programs or reducing annual mileage.

4. Coverage for Renewable Energy Projects

A solar farm secures insurance for:

- Weather-related damages.

- Operational risks, including grid failures or equipment breakdown.

5. Coastal Properties Protection

Homes located near the coast are protected against rising sea levels and flooding. The policy includes green rebuilding options after damage.

Also Read: What Is Green Insurance And How Does It Benefit The

Conclusion

Eco insurance is more than just a financial product; it’s a step toward a sustainable future. For green-minded consumers, these policies offer the perfect balance of environmental responsibility and financial security. By choosing eco insurance, you’re not only protecting your assets but also contributing to global sustainability.

7 Frequently Asked Questions (FAQs)

What makes eco insurance different from regular insurance?

Eco insurance focuses on sustainability by rewarding green behavior, covering eco-friendly assets, and supporting renewable energy projects.

Who can benefit from eco insurance?

Eco insurance is ideal for individuals, families, and businesses committed to sustainability and owning eco-friendly assets like EVs or solar panels.

3. Are there any tax benefits associated with eco insurance?

In some regions, governments offer tax incentives for businesses and individuals adopting green insurance policies.

4. Can I switch from traditional insurance to eco insurance?

Yes, many insurers allow policyholders to transition to eco insurance with flexible terms.

5. Is eco insurance only for renewable energy projects?

No, eco insurance covers a broad range of assets, including energy-efficient homes, green vehicles, and climate risk protection.

6. How does eco insurance support climate resilience?

Eco insurance includes coverage for climate-related risks, such as extreme weather events, ensuring financial stability during disasters.

7. What should I look for in an eco insurance provider?

Check for providers with sustainability certifications, carbon-neutral operations, and positive reviews on green initiatives.