Legal Insurance

auto insurance claims, claim approval, claim assistance, claim disputes, claim resolution, claim tracking, claims adjuster, claims appeal, claims denial, claims documentation, claims filing, claims handling, claims management, claims negotiation, claims procedure, claims process, claims review, claims settlement, claims settlement process, claims support, filing an insurance claim, health insurance claims, insurance claim process, insurance claims, insurance coverage, insurance policy claims, insurance reimbursement, legal claims, medical claims, personal injury claims, property damage claims, workers compensation claims

info.kingwell

0 Comments

What is the Claims Process? A Comprehensive Guide to Understanding It

In the world of insurance, legal, and consumer protection, the term “claims process” refers to the procedure one must follow to seek compensation, reimbursement, or redress from a provider or institution after experiencing a loss, injury, or damage. Whether it’s a claim for property damage, health insurance, or workers’ compensation, understanding how the claims process works can help individuals navigate potential complexities and ensure they receive the coverage or compensation they deserve.

This article explores the various steps involved in the claims process, how it works in different industries, and offers valuable insights for consumers, legal professionals, and businesses to understand the ins and outs of claim submissions and resolutions.

Key Takeaways

| Key Point | Description |

|---|---|

| Claims Process Steps | Filing, Review, Assessment, Approval, Settlement, and Appeal. |

| Types of Claims | Insurance, Legal, Property, Consumer, Workers’ Compensation. |

| Importance of Documentation | Proper evidence like receipts, photos, and reports are essential for claim success. |

| Appeals Process | If denied, most claims offer an appeal process for reconsideration. |

| Timeframe | Claim processing times can vary depending on complexity. |

| Policy Terms | Always check the specific terms of your policy for exclusions or coverage. |

| Legal Assistance | Consult legal experts for guidance, especially in complex claims. |

What is the Claims Process?

The claims process is a series of steps that a policyholder, customer, or claimant follows to file a formal request for compensation or reimbursement from an insurance company, service provider, or another entity. Depending on the nature of the claim, whether it’s health, auto, property, or legal, the process may vary slightly, but there are key commonalities across most claims processes.

Key steps typically involved include:

- Filing the Claim: The claimant submits a formal notification to the relevant organization, describing the nature of the loss or damage.

- Claim Review and Investigation: The organization (e.g., insurance company, legal entity) reviews the claim’s details and investigates the circumstances surrounding the claim.

- Assessment: After reviewing, the company assesses the legitimacy and validity of the claim to determine how much, if anything, they are liable for.

- Approval or Denial: Based on the findings, the claim is either approved, partially approved, or denied.

- Settlement: If approved, a settlement is reached, and compensation or reimbursement is issued to the claimant.

- Appeal (if applicable): If the claim is denied or the claimant disagrees with the decision, an appeal process is often available.

Each of these steps ensures the claims process is transparent, efficient, and fair, while offering protections to both the claimant and the provider.

Types of Claims

The claims process can vary based on the type of claim being filed. Below are a few common types of claims and their unique considerations:

1. Insurance Claims

Insurance claims are the most well-known type of claim. These can be filed for various insurance products such as health, auto, home, or life insurance. Depending on the policy and coverage, the process can differ.

- Health Insurance Claims: A claimant files a claim with their health insurance provider for medical expenses incurred.

- Auto Insurance Claims: In the case of an accident, a policyholder may file a claim with their insurer to recover costs for repairs or medical expenses.

- Homeowners Insurance Claims: A homeowner files a claim after experiencing damage to their property due to events like fire, water damage, or theft.

2. Workers’ Compensation Claims

When an employee is injured at work, they may file a workers’ compensation claim. These claims often cover medical expenses and lost wages due to the injury. Workers’ compensation claims must be filed with the employer’s insurance provider, and a series of forms may be involved to verify the injury and extent of the damages.

3. Legal Claims

Legal claims refer to the process of seeking compensation for personal injury, contractual breaches, property disputes, or other legal matters. These claims often require the involvement of legal professionals to navigate the legal system and ensure the claimant receives a fair settlement or compensation.

- Personal Injury Claims: If an individual is injured due to someone else’s negligence, they can file a personal injury claim against the responsible party.

- Product Liability Claims: When a consumer is injured due to a defective product, they may file a product liability claim.

4. Property Claims

Property claims arise when an individual or organization seeks compensation for property damage due to accidents, natural disasters, or theft. These claims are usually filed with the property owner’s insurance provider and require an assessment of the damages involved.

5. Consumer Claims

Consumer claims involve disputes between consumers and businesses. Examples include warranty claims, fraud claims, or defective product claims. Such claims may be handled by consumer protection agencies, regulators, or through legal avenues.

Key Stages in the Claims Process

The general claims process, while slightly different for each industry, typically follows these stages:

Filing the Claim

The first step in the process is for the claimant to formally notify the responsible party (e.g., the insurance company, business, employer, or other entity) of the loss, damage, or injury. The following information is typically required when filing a claim:

- Details of the incident or event: Describe when, where, and how the incident occurred.

- Documentation: Provide supporting evidence like receipts, medical reports, photos of damage, or police reports.

- Claim Forms: Many organizations require claimants to fill out specific forms that capture detailed information about the event.

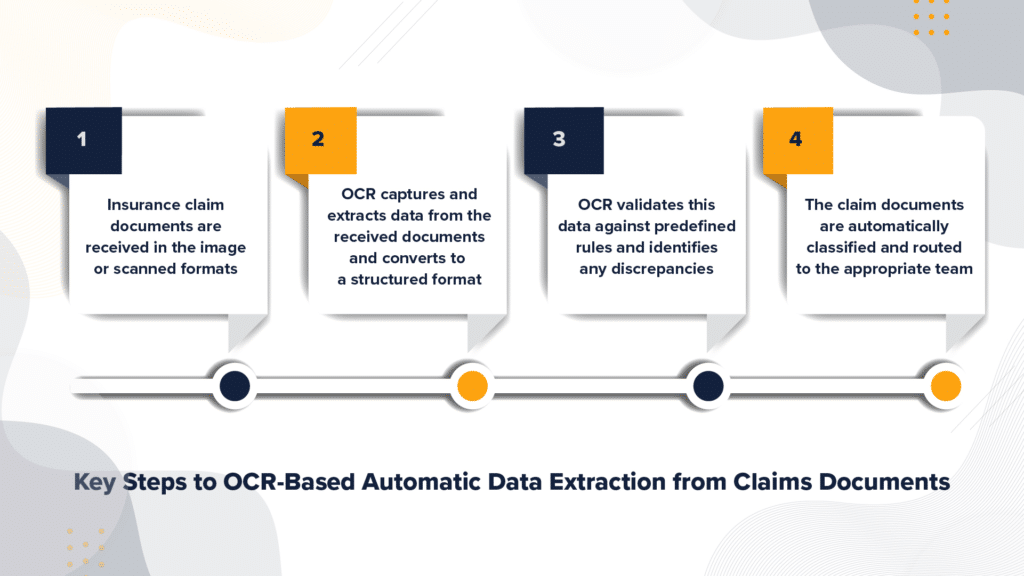

Claim Review and Investigation

Once the claim is submitted, the responsible party (such as an insurance company) will review the details of the claim. Investigators may be employed to assess the validity of the claim and determine the extent of liability.

During this phase, several things may happen, including:

- Interviews with the claimant and witnesses.

- Collection of evidence (e.g., accident reports, photos).

- Assessment of medical or repair costs.

- Review of any applicable policy terms or legal requirements.

Claim Assessment and Evaluation

After reviewing the claim, the organization evaluates it to determine if it’s valid and how much compensation the claimant is entitled to. In the case of insurance, this involves examining the terms of the policy to ensure the event or loss is covered.

Key aspects of the assessment include:

- Policy Limits: Checking the maximum coverage limits in place.

- Exclusions: Ensuring the loss isn’t excluded under the policy.

- Damages Assessment: Determining the total cost of damages or losses, such as repair costs, medical bills, or lost wages.

Approval or Denial of the Claim

Once the evaluation is complete, the claim is either approved or denied based on the findings. If the claim is approved, the organization proceeds to the settlement phase.

Settlement and Payment

If the claim is approved, the claimant receives compensation as per the terms of the policy or agreement. In the case of insurance claims, this typically involves payment for damages, medical expenses, or other costs related to the claim.

Appeal (If Applicable)

If the claim is denied, the claimant has the option to appeal the decision. The appeals process varies depending on the provider or organization but generally involves a formal review of the claim and any additional evidence presented by the claimant.

Here are some more detailed topics related to the claims process that can help expand your understanding of how it works in various industries, scenarios, and legal contexts. These topics cover different aspects of claims filing, reviewing, and settlement, addressing both practical and legal nuances.

Claims Process in Insurance

Health Insurance Claims Process

- How to File a Health Insurance Claim: The specific steps involved in submitting a health insurance claim, including gathering medical bills, submitting claim forms, and dealing with insurance adjusters.

- Claims Denial and Appeals: Common reasons for health insurance claim denial and the procedure for appealing a decision. This can include issues like pre-existing conditions, lack of coverage, or incorrect billing codes.

- Out-of-Network Claims: How the claims process differs when treatment is received from out-of-network providers and how to submit claims for reimbursement.

- Co-Payments, Deductibles, and Coinsurance: Understanding how different costs affect the final reimbursement and the impact on the claims process.

- Pre-Authorization Requirements: Some procedures may require pre-authorization from the insurance provider. Discussing how this impacts the claims process and the steps to take if pre-authorization is denied.

Auto Insurance Claims Process

- Filing a Claim After an Accident: Detailed steps for filing an auto insurance claim, including exchanging information, documenting the scene, and contacting your insurer.

- Repair and Replacement of Damaged Vehicles: Understanding the process for getting your car repaired or replaced and the role of insurance adjusters in evaluating the damage.

- Dealing with Insurance Adjusters: How to communicate effectively with auto insurance adjusters, what to expect during the assessment, and how to avoid pitfalls in the process.

- Understanding Liability and Fault in Auto Insurance Claims: How the claims process is affected by who is at fault in the accident and how comparative negligence impacts payouts.

Homeowners Insurance Claims Process

- What to Do After Property Damage: Steps to take when filing a homeowners insurance claim after events like fire, storm damage, theft, or vandalism.

- Claims for Loss of Personal Property: Understanding the process of filing a claim for damaged or stolen personal property and the importance of inventory lists.

- How to Deal with Adjusters and Contractors: Tips for handling adjusters and contractors who assess damages and the repairs needed, ensuring you get fair compensation.

- Flood and Earthquake Insurance: How claims for damage caused by natural disasters like floods and earthquakes differ from regular homeowners insurance claims.

- Dispute Resolution in Homeowners Insurance Claims: What to do if there’s a disagreement with your insurer over compensation amounts or policy terms.

Legal Claims Process

Personal Injury Claims

- Filing a Personal Injury Claim: Detailed steps in the personal injury claims process, including gathering evidence, working with lawyers, and filing with the appropriate court or insurance provider.

- Medical Malpractice Claims: The complex process of claiming compensation for injuries caused by medical malpractice, including proving negligence and dealing with insurance providers.

- Product Liability Claims: The process of filing claims against manufacturers or sellers for defective products that cause harm or damage.

- Negotiation and Settlement in Personal Injury Claims: How settlement negotiations work, the role of mediators, and how to calculate the value of a personal injury claim.

- Statute of Limitations for Personal Injury Claims: The importance of filing your claim within the legal time frame and how the statute of limitations affects your case.

Workers’ Compensation Claims Process

- Reporting Work-Related Injuries: How to report an injury or illness sustained at work and what documentation is necessary.

- Receiving Medical Care and Benefits: The process of receiving medical care under workers’ compensation insurance and what benefits you’re entitled to for lost wages and medical costs.

- Dealing with Disputes in Workers’ Compensation Claims: What to do if the insurance company denies the claim, delays payment, or disputes the extent of the injury.

- Appeals Process in Workers’ Compensation Claims: The steps for appealing a denied claim and the role of administrative hearings and legal representation.

Disability Claims

- Filing for Disability Insurance Claims: The process for filing short-term or long-term disability claims, including what documentation is required (e.g., medical records, doctor’s notes).

- Social Security Disability Claims: A guide to applying for Social Security Disability Insurance (SSDI), the evaluation process, and common reasons for claim denial.

- Disability Claims for Mental Health Conditions: The challenges of filing a disability claim based on mental health conditions, such as depression or anxiety, and the documentation needed.

- Appeals Process for Denied Disability Claims: How to handle a denied disability claim, including gathering additional evidence and requesting a hearing.

Business and Consumer Claims

Small Business Claims Process

- Filing Claims for Business Interruption Insurance: What steps small businesses should take to file claims for business interruption caused by disasters, accidents, or pandemics.

- Product Defects and Liability Claims: A guide to how small businesses can file claims for defective products or defective workmanship, particularly in industries like manufacturing and retail.

- Cybersecurity and Data Breach Claims: The process for filing claims after a data breach or cybersecurity incident, including notifying affected customers and dealing with insurers.

- Property Damage Claims for Businesses: Steps for businesses to take in filing property damage claims for events such as fire, flooding, or theft.

- Workers’ Compensation for Small Businesses: Understanding the workers’ compensation process for small businesses, including how to handle claims made by employees for work-related injuries.

Consumer Protection Claims

- Consumer Fraud Claims: A guide to filing a claim for consumer fraud, including steps to take when dealing with deceptive practices, false advertising, or scams.

- Breach of Warranty Claims: The process for filing claims related to the breach of warranties on consumer products, including the requirements and timeline.

- Class Action Claims: The process of joining or initiating a class action lawsuit to address a widespread issue affecting multiple consumers.

- Defective Goods or Services Claims: How consumers can file claims when they are sold defective goods or services and what compensation they can seek.

- Dispute Resolution in Consumer Claims: How alternative dispute resolution (ADR) methods, like mediation and arbitration, are used to resolve consumer disputes.

Claims Process in Government Programs

Social Security and Pension Claims

- Filing Social Security Claims: The process of filing for Social Security benefits, including eligibility criteria and required documentation.

- Pension and Retirement Benefit Claims: The claims process for pension or retirement benefits from government or private plans, including how to navigate claims that are delayed or denied.

- Veterans Benefits Claims: The process veterans must follow to apply for benefits, compensation, or disability claims related to their military service.

- Unemployment Claims: How to file for unemployment insurance benefits, eligibility, and common reasons claims are denied or delayed.

- Government Benefits for Disabled Individuals: The process of filing claims for various government benefits available to individuals with disabilities, including financial support and healthcare coverage.

International Claims Process

Cross-Border Claims

- International Insurance Claims: How claims for insurance policies that cover international travel, property, or health insurance differ from domestic claims.

- International Arbitration for Claims: The role of arbitration in resolving disputes between parties from different countries, including commercial, legal, or property disputes.

- Claims for Damage or Injury Abroad: The process of seeking compensation for injuries or damage sustained while abroad, including the complexities of foreign laws and regulations.

- Claims under International Trade Agreements: How businesses can file claims under trade agreements or treaties to resolve disputes in cross-border commerce.

Extradition and International Legal Claims

- Extradition Claims and Legal Assistance: The claims process related to international extradition, including the role of legal representation and inter-governmental agreements.

- Human Rights Violations and Claims: The process of filing claims related to human rights violations that involve multiple countries and international law bodies like the United Nations or the International Court of Justice.

- Asylum and Refugee Claims: The process refugees go through when filing claims for asylum in a foreign country, including documentation and interviews with immigration authorities.

- International Product Liability Claims: Filing claims for products manufactured in one country that cause harm in another, and the legal complexities involved in pursuing these claims internationally.

Dispute Resolution and Claims

Alternative Dispute Resolution (ADR) in Claims

- Mediation in Claims Process: How mediation helps resolve disputes without going to court, and how it fits into various claims processes, including insurance and legal claims.

- Arbitration vs. Litigation in Claims: Comparing arbitration to traditional litigation and understanding when arbitration is preferred in claims resolution.

- Negotiation in Claims Settlements: The importance of negotiation skills in resolving claims and reaching satisfactory settlements before going to court.

Read More : What is Dispute Resolution and How Does It Work?

Conclusion

Understanding the claims process is vital for both individuals and businesses to ensure timely, effective resolutions when disputes or damages occur. Whether you are dealing with insurance claims, workers’ compensation, or consumer disputes, knowing the steps and how to navigate them can significantly ease the process and help avoid unnecessary delays.

Claims can often be complicated, involving legal details, policy terms, and evidence gathering. Hence, it is advisable for claimants to keep organized records, understand their rights, and consult with professionals when necessary to improve the chances of a successful claim.

FAQs

1. What is the average time for a claim to be processed?

The time it takes to process a claim varies by type, complexity, and the provider involved. For example, health insurance claims may take several weeks, while auto claims may be processed in a few days to weeks.

2. Can a claim be denied?

Yes, claims can be denied if the provider determines that the event is not covered by the policy or if there is insufficient evidence to support the claim.

3. What documentation do I need to file a claim?

Common documentation includes incident reports, medical bills, repair receipts, witness statements, and photographs of damages.

4. Can I appeal a denied claim?

Yes, most claims processes include an appeal mechanism where the claimant can challenge the decision, often by submitting additional evidence or clarifying the details.

5. How do I know if my claim is legitimate?

A legitimate claim typically arises from an event covered by a policy or legal agreement. Reviewing the terms of your insurance policy or agreement with the service provider can clarify your rights.

6. What happens if I don’t file a claim immediately?

Failing to file a claim promptly can result in delays or, in some cases, a denial of the claim, especially if the statute of limitations has passed.

7. Are there any costs involved in filing a claim?

Some claims may involve filing fees, legal costs, or deductibles. However, many insurance claims do not require upfront fees.