Travel Insurance

affordable travel insurance, best travel insurance rates, budget travel insurance, cheap travel insurance, cost of travel insurance, cost-effective travel insurance, domestic travel insurance cost, flight insurance fees, holiday insurance cost, insurance charges, insurance fee comparison, insurance for travel, insurance for trips, insurance premiums for trips, international travel insurance fees, medical travel insurance fees, travel coverage fees, travel insurance costs, travel insurance expenses, travel insurance fee, travel insurance fee breakdown, travel insurance for vacations, travel insurance payment, travel insurance plans, travel insurance policy cost, travel insurance premiums, travel insurance pricing, travel insurance quote, travel insurance rates, travel protection fees, trip insurance fees

mahainsurance

0 Comments

Travel Insurance Fee Explained: How To Get The Best Value For Your Money

Traveling can be an exciting and enriching experience, but it also comes with its share of risks. Whether you’re traveling for leisure, business, or any other purpose, unexpected situations such as medical emergencies, lost luggage, trip cancellations, or flight delays can occur. That’s where travel insurance comes in – providing a financial safety net for unforeseen events that may disrupt your travel plans.

When purchasing travel insurance, understanding the travel insurance fee is essential to ensure that you are getting the best value for your money. In this article, we will break down the components of travel insurance fees, how they are calculated, and provide tips on how to make sure you’re getting the best deal possible for your needs.

Key Takeaway

Travel insurance is a valuable investment for travelers, but it’s important to ensure that you’re paying for the right coverage at the best price. By understanding how travel insurance fees are calculated and following strategies to customize your policy, you can enjoy peace of mind during your trip without overspending on unnecessary coverage.

What Is Travel Insurance Fee?

A travel insurance fee is the amount you pay to the insurance company for coverage against potential risks that could disrupt your trip. This fee, commonly referred to as a premium, varies based on multiple factors, such as the type of policy you choose, the duration of your trip, your destination, and your age.

The purpose of paying the travel insurance fee is to secure coverage for various travel-related risks, such as trip cancellations, delays, medical emergencies, lost baggage, and more. The amount of the fee you pay depends on the level of coverage you require and the amount of risk involved in your specific travel situation.

Factors Affecting Travel Insurance Fee

Several factors play a significant role in determining the cost of your travel insurance fee. Understanding these factors will help you make informed decisions when comparing different insurance plans and help you choose the most cost-effective option.

Trip Duration

The longer your trip, the higher the travel insurance fee is likely to be. Travel insurance providers calculate fees based on the length of time you will be traveling. Therefore, a weekend getaway would cost less in insurance premiums compared to a month-long international vacation.

Destination

Your destination plays a crucial role in determining your travel insurance fee. Some countries pose a higher risk due to political instability, healthcare costs, or environmental hazards (such as natural disasters), leading to higher premiums. For example, traveling to regions with high medical costs or areas prone to extreme weather events could increase your insurance fee.

Coverage Type

The level of coverage you choose will affect the overall insurance fee. Standard travel insurance covers basic risks, such as trip cancellation and medical emergencies, while more comprehensive policies may include additional protection like lost baggage, trip interruption, or coverage for adventure activities (e.g., skiing, scuba diving). The more coverage you require, the higher the fee.

Your Age

Older travelers may face higher travel insurance premiums due to the increased likelihood of medical issues and the need for more comprehensive coverage. Insurers often charge higher fees for travelers over the age of 60 or 65, although some companies may offer discounted rates for younger travelers.

Medical History

Travelers with pre-existing medical conditions may be subject to higher premiums or exclusions for certain types of coverage. Be sure to disclose any pre-existing medical conditions when purchasing your policy, as failing to do so could result in a denied claim if medical issues arise while you’re traveling.

Trip Cost

Many travel insurance providers base the premium on the total cost of your trip. For example, if you’ve booked an expensive vacation with non-refundable hotel reservations and flights, you will likely pay a higher insurance fee. Insurers typically offer trip cancellation coverage as a percentage of the trip cost to cover any non-refundable expenses in case you need to cancel.

Activities During Your Trip

If you plan to engage in high-risk activities, such as skiing, bungee jumping, or skydiving, the travel insurance fee may increase. These activities carry a higher risk of injury, so insurers may offer special coverage or charge extra for these types of plans.

Decoding Travel Insurance Costs: A Guide to Fees and Coverage

When it comes to planning a trip, there’s more to consider than just the destination, accommodation, and flights. One important aspect that should not be overlooked is travel insurance. It offers crucial protection against unexpected events like trip cancellations, medical emergencies, lost baggage, or flight delays. However, before purchasing travel insurance, it’s important to fully understand the costs involved and how coverage works. This article breaks down travel insurance fees, explores the types of coverage available, and provides guidance on how to ensure you’re getting the best value for your money.

What is Travel Insurance and Why is It Important?

Travel insurance is a policy designed to cover financial losses incurred due to unexpected incidents while traveling. These incidents can range from medical emergencies, natural disasters, or unforeseen events such as trip cancellations and delays. While the cost of travel insurance might seem like an additional expense, the protection it provides can save you from larger financial burdens in case things go wrong.

Key reasons to consider travel insurance:

- Trip cancellations: If you need to cancel your trip for covered reasons, insurance may reimburse you for non-refundable expenses like flights, hotel stays, and activities.

- Medical coverage: In case of a medical emergency while abroad, travel insurance provides access to healthcare and may cover the costs of treatment.

- Trip interruptions: If your travel plans are disrupted by unforeseen events such as weather-related delays or emergencies, insurance may help reimburse you for missed connections and rescheduled travel.

- Lost or delayed baggage: If your baggage is lost, stolen, or delayed, travel insurance can help reimburse you for the cost of replacing essential items.

Understanding Travel Insurance Fees

The travel insurance fee, also known as the premium, is the amount you pay to the insurance company to purchase coverage. The fee can vary based on several factors, and it’s important to understand what influences the cost to make an informed decision. Here are some of the key factors that impact the cost of your travel insurance fee.

Type of Coverage

Travel insurance policies come with different levels of coverage. The more comprehensive the coverage, the higher the cost will likely be. The most common types of coverage include:

- Basic Travel Insurance: Covers trip cancellation, travel delays, lost baggage, and emergency medical expenses.

- Comprehensive Travel Insurance: Offers a broader range of coverage, including trip interruption, emergency evacuation, and coverage for extreme sports or adventure activities.

- Single Trip vs. Annual Travel Insurance: Single-trip insurance covers one specific journey, while annual plans offer coverage for multiple trips over the course of a year. If you travel frequently, an annual plan might offer more value, although the upfront fee may be higher.

The length of your trip directly affects your insurance premium. Longer trips usually result in higher fees, as there is a greater chance that something could go wrong. Insurers calculate premiums based on the number of days you’ll be traveling.

Travel Destination

Where you’re traveling also plays a role in your travel insurance fee. Some countries or regions pose a higher risk due to factors like healthcare costs, political instability, or environmental hazards (e.g., areas prone to natural disasters). Insurance providers charge higher premiums for trips to these destinations.

Age and Health of the Traveler

Your age and medical history are significant factors in calculating your travel insurance premium. Older travelers or those with pre-existing medical conditions may face higher fees due to the increased likelihood of needing medical attention while traveling. Be sure to disclose your medical history when purchasing insurance, as failing to do so may result in denied claims later.

Trip Cost

Some insurance policies are priced based on the total cost of your trip. If your trip is expensive, your premium will be higher because there are more financial risks involved. For example, if you’re traveling for business with non-refundable hotel bookings or flight tickets, the higher the trip cost, the higher the insurance fee to protect those investments.

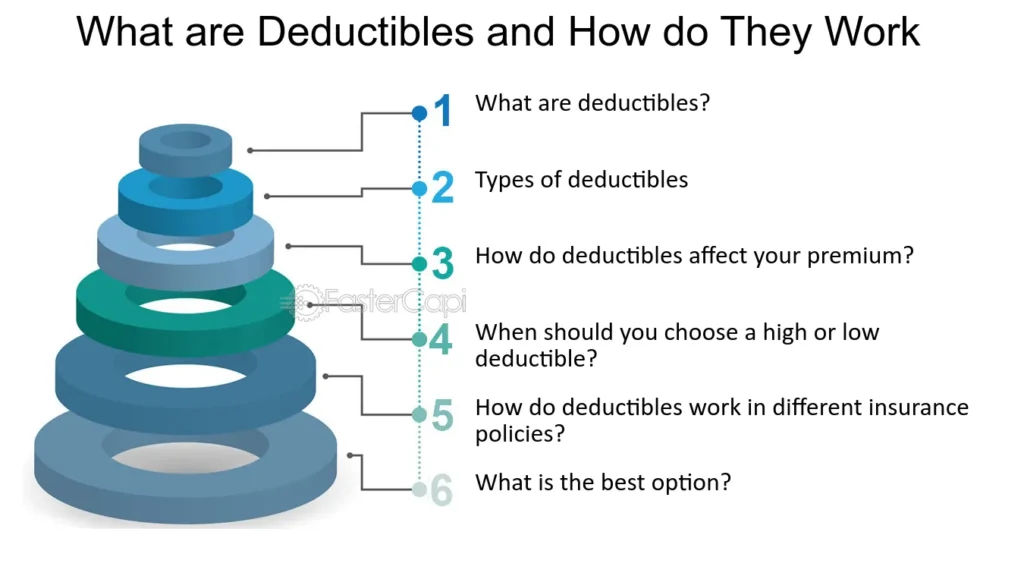

Deductibles and Policy Limits

Travel insurance policies often come with deductibles (the amount you pay out-of-pocket before the insurance kicks in) and policy limits (the maximum amount the insurer will pay for claims). Opting for higher deductibles can lower your premium, but this means you’ll be responsible for more costs if you need to file a claim.

Different Types of Coverage in Travel Insurance

Understanding the different types of travel insurance coverage is crucial to selecting a plan that provides the protection you need. Let’s explore some of the most common types of coverage included in travel insurance policies:

Trip Cancellation/Interruption Coverage

This is one of the most popular types of coverage, especially for expensive trips. Trip cancellation coverage reimburses you for non-refundable expenses (flights, hotels, activities) if you need to cancel your trip due to unforeseen circumstances like illness, a family emergency, or other covered reasons. Trip interruption covers you if your trip is interrupted and you need to cut it short due to unforeseen events.

Medical Emergency Coverage

Traveling abroad can expose you to health risks, and many health insurance policies don’t cover overseas emergencies. Medical emergency coverage provides access to emergency medical treatment, hospitalization, and medical evacuation if necessary. Some policies also cover emergency dental treatment.

Lost, Stolen, or Delayed Baggage Coverage

Lost baggage is a common headache when traveling, and it can be costly to replace essential items. Travel insurance typically covers the cost of replacing lost, stolen, or delayed baggage. Some plans will even reimburse you for necessary items if your baggage is delayed for a certain period.

Emergency Evacuation Coverage

If you’re traveling to remote or dangerous areas, you might need emergency evacuation coverage. If there’s a natural disaster, civil unrest, or a medical emergency, this coverage will help you get to safety, whether it’s through emergency airlifts or transport to the nearest medical facility.

Adventure Sports Coverage

For travelers engaging in high-risk activities like skiing, diving, or hiking, adventure sports coverage is important. Some standard travel insurance policies exclude coverage for risky activities, so adding this extra coverage is essential if you plan to participate in such activities.

How to Get the Best Value for Your Money

When shopping for travel insurance, there are several strategies you can use to ensure you’re getting the best coverage at the most reasonable price.

Compare Multiple Insurance Providers

Don’t settle for the first travel insurance quote you receive. Use online comparison tools to compare different insurance plans and see what each policy covers. Consider the type of trip you’re taking, your destination, and the activities you’ll be doing to choose the right coverage. Comparing quotes will help you make a more informed decision and may help you find the most affordable plan.

Read the Fine Print

Always carefully read the terms and conditions of the policy. Pay close attention to exclusions, limitations, and coverage limits. Knowing exactly what is covered—and what isn’t—will prevent any surprises later on.

Choose the Coverage You Need

Don’t pay for unnecessary coverage. If you’re traveling to a country with a good healthcare system and have access to travel medical insurance through your credit card, you may not need additional medical coverage. Focus on the areas where you feel most vulnerable, such as trip cancellation or lost baggage, and only purchase what you need.

Buy Early for Better Deals

Purchasing travel insurance early often results in lower premiums. Some insurers offer early-bird discounts, so it’s worth looking into insurance as soon as you book your trip. Additionally, buying insurance early protects you from cancellations that may occur before your trip, ensuring you’re covered from the moment you plan your travel.

How To Get the Best Value for Your Money

While it’s important to get the right coverage for your trip, it’s equally important to ensure that you’re getting good value for your travel insurance fee. Below are some strategies that can help you save money without compromising on the quality of coverage.

Compare Multiple Quotes

Not all insurance providers offer the same premiums or coverage options. It’s important to shop around and compare quotes from multiple insurers before choosing a policy. This way, you can assess which provider offers the best balance of coverage and cost.

Use online comparison tools to get an overview of different plans. You can input details such as your travel destination, duration, and activities to see a side-by-side comparison of premiums. Don’t forget to read the fine print to ensure you understand what each policy includes.

Customize Your Coverage

Travel insurance providers often offer a range of plans with different levels of coverage. Before purchasing a policy, assess your specific needs and determine which coverage options are essential for your trip. For example, if you’re traveling to a developed country with good healthcare, you may not need medical evacuation coverage. By customizing your policy, you can avoid paying for unnecessary coverage and save on your insurance fee.

Check for Discounts

Some travel insurance providers offer discounts for certain groups, such as frequent travelers, students, or members of travel clubs. Additionally, bundling multiple insurance policies (e.g., trip cancellation and medical coverage) with the same provider may result in cost savings. Check if you’re eligible for any discounts before purchasing your policy.

Buy in Advance

Purchasing travel insurance in advance, rather than waiting until the last minute, can often result in a lower premium. Many insurance providers offer early booking discounts, especially if you purchase the policy when you first book your trip. Additionally, buying insurance early ensures that you are protected in case you need to cancel or alter your travel plans.

Consider Annual Plans for Frequent Travelers

If you travel frequently, you might benefit from an annual travel insurance plan, which covers multiple trips throughout the year. While the initial premium may be higher, it could save you money in the long run by covering multiple trips without needing to purchase separate insurance policies for each one.

Evaluate the Deductible

Just like health insurance, travel insurance often includes a deductible—the amount you need to pay out-of-pocket before your coverage kicks in. Some policies offer lower premiums in exchange for higher deductibles. If you’re comfortable covering a larger portion of expenses in the event of a claim, choosing a higher deductible can reduce your insurance fee.

Review Exclusions and Limits

It’s crucial to carefully review the exclusions and limits of any travel insurance policy before purchasing. Some policies may exclude certain risks, like adventure sports or certain destinations. Additionally, policies often have coverage limits for medical expenses or trip cancellations. Make sure you’re comfortable with these limits and that the policy covers everything you need.

Also Read: Choosing The Right Travel Insurance Consultants: Your

Conclusion

Travel insurance fees are a crucial consideration when preparing for any trip, as they ensure you’re financially protected in the event of unforeseen circumstances. Understanding the factors that impact the cost of travel insurance and knowing how to get the best value for your money can make all the difference in selecting the right policy. By comparing quotes, customizing coverage, looking for discounts, and reviewing the details of each policy, you can secure affordable protection without compromising on coverage.

FAQs

What does travel insurance cover?

Travel insurance typically covers trip cancellations, medical emergencies, trip delays, lost baggage, and emergency evacuations. Some plans also cover adventure sports, natural disasters, and other travel-related risks.

How is the cost of travel insurance calculated?

The cost of travel insurance is calculated based on factors like trip duration, destination, age, coverage type, trip cost, and activities. Longer trips, higher-risk destinations, and additional coverage will increase the premium.

Is travel insurance worth the cost?

Travel insurance is often worth the cost if you’re traveling abroad or to a destination with high medical expenses or potential risks. It provides financial protection and peace of mind in case something goes wrong during your trip.

Can I get travel insurance after booking my trip?

Yes, you can buy travel insurance after booking your trip. However, purchasing it early provides more comprehensive coverage, especially for trip cancellation or interruption.

Does travel insurance cover pre-existing medical conditions?

Some travel insurance policies may cover pre-existing medical conditions, but you will likely need to purchase a special rider or provide proof of your medical condition. Be sure to check the terms and conditions before purchasing.

Can I change my travel insurance plan after purchasing it?

Depending on the insurer, you may be able to modify your policy after purchase, such as adjusting the coverage limits or adding extra coverage. Be sure to contact the insurance provider as soon as possible if changes are needed.

Does travel insurance cover trip cancellations due to personal reasons?

Standard travel insurance usually only covers cancellations for covered reasons, such as illness, injury, or natural disasters. Cancellations due to personal reasons may not be covered unless you purchase “Cancel for Any Reason” coverage, which is an optional add-on.