green insurance

Carbon Footprint Reduction, Climate Change, Climate Resilience, Corporate Responsibility, Eco-Conscious Consumers, Eco-Friendly Insurance, Economic Growth, Electric Vehicles, Energy Efficiency, Environmental Protection, Environmental Risk Coverage., Green Building Insurance, Green Global Economy, Green Global Policies, Green Infrastructure, Green Insurance, Green Insurance Benefits, Green Policies, Green Technologies, Green Urban Development, Hydro Insurance, Insurance for Agriculture, Insurance for Sustainability, Low-Emission Vehicles, Renewable Energy, Renewable Energy Incentives, Risk Management, Solar Insurance, Sustainable Business Practices, Sustainable Insurance, Sustainable Practices, Wind Energy Insurance

mahainsurance

0 Comments

How Green Global Insurance Is Driving Environmental Change And Economic Growth

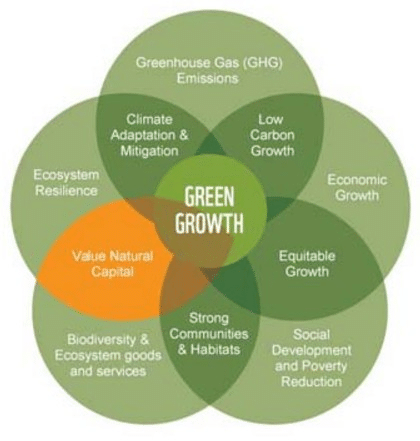

In recent years, environmental sustainability has emerged as a critical concern for industries across the globe. The challenges of climate change, biodiversity loss, pollution, and resource depletion are increasingly influencing corporate strategies, policies, and consumer behavior. As businesses and governments work to address these challenges, a new trend is gaining momentum: green global insurance. Green insurance is a growing sector in the insurance industry that promotes environmental sustainability by incentivizing eco-friendly practices and mitigating environmental risks.

In this article, we will explore how green global insurance is contributing to environmental change and driving economic growth. We’ll discuss the role of insurance in sustainability, how it works in the context of green initiatives, its benefits, the challenges it faces, and why it’s crucial for a sustainable future.

Key Takeaways

- Green insurance incentivizes sustainability by rewarding businesses and individuals for adopting eco-friendly practices.

- It promotes the adoption of renewable energy through specialized policies for solar, wind, and other clean energy projects.

- Green insurance reduces financial risks related to environmental and climate-related events, helping businesses recover from losses and adapt to new risks.

- It fosters economic growth by creating new opportunities in green technologies, creating jobs, and encouraging investment in sustainability.

- Green insurance helps build resilience to climate change by offering coverage for infrastructure designed to withstand extreme weather events.

What is Green Global Insurance?

Green global insurance refers to a category of insurance products designed to support environmentally friendly practices, help mitigate climate-related risks, and foster a transition to a low-carbon economy. The concept is rooted in the idea that insurers can play a pivotal role in driving sustainability by offering policies that support renewable energy projects, energy efficiency, and the reduction of carbon footprints.

These insurance policies incentivize individuals, businesses, and governments to adopt eco-friendly practices by providing financial protection against environmental risks while rewarding sustainable actions. By covering areas such as renewable energy systems, green buildings, sustainable agriculture, and low-emission vehicles, green insurance helps bridge the gap between traditional risk management and environmental responsibility.

The Role of Green Global Insurance in Environmental Change

Green global insurance is not just about providing financial protection against risks but also about shaping a new paradigm where the environmental impact of insured activities is minimized. Here’s how green insurance is driving environmental change:

1. Encouraging the Use of Renewable Energy

One of the significant ways green insurance is promoting environmental change is by encouraging the adoption of renewable energy sources. Many green insurance products offer lower premiums or other incentives for individuals and businesses that invest in solar, wind, or other renewable energy systems.

- Solar Energy Insurance: For instance, insurance policies for solar power installations help protect the investments in solar panels, batteries, and other renewable energy equipment. As solar energy becomes more common, insurance products tailored to these systems are essential for reducing risks related to system failure, damage from weather events, or other operational issues.

- Wind and Hydro Insurance: Green global insurance also supports large-scale renewable projects, such as wind farms and hydroelectric plants, by offering tailored coverage that mitigates the risks associated with these infrastructures.

2. Reducing Carbon Footprints Through Incentives

Green global insurance also works by offering incentives for businesses and individuals to reduce their carbon footprints. This includes discounts on premiums for low-emission vehicles, energy-efficient homes, and companies with sustainable practices.

- Electric Vehicle (EV) Insurance: As the world moves towards electric vehicles (EVs), green insurance policies are stepping in to promote this shift. Insurers offer discounted premiums for owners of electric vehicles or hybrid cars, encouraging more people to transition away from fossil fuel-powered vehicles.

- Home Energy Efficiency: Homeowners who install energy-efficient systems, such as energy-efficient windows, smart thermostats, or insulation, may be eligible for lower premiums, as these upgrades reduce energy consumption and promote a more sustainable living environment.

3. Supporting Green Buildings and Sustainable Construction

The construction industry is one of the largest contributors to carbon emissions, but green insurance is helping to reduce the environmental impact of buildings through sustainable construction practices. Green insurance policies cover buildings designed to meet environmentally friendly standards, such as LEED (Leadership in Energy and Environmental Design) certification.

- Green Building Coverage: Insurers offer specialized coverage for green buildings that incorporate energy-saving technologies like solar panels, geothermal heating systems, and rainwater harvesting. By providing these insurance products, insurers incentivize the construction of more eco-friendly buildings and help offset the risks associated with environmentally conscious designs.

- Sustainable Infrastructure: Insurance policies that cover green infrastructure, such as green roofs, permeable pavements, and urban wetlands, contribute to more sustainable urban development, supporting cities in their efforts to mitigate the effects of climate change.

4. Promoting Sustainable Agriculture Practices

Green global insurance also helps promote sustainable farming practices by providing coverage for agriculture that implements eco-friendly methods. Organic farming, reduced pesticide use, crop diversification, and agroforestry are all practices that align with green insurance principles.

- Agro-Insurance for Sustainable Practices: Green insurance policies can support farmers who adopt sustainable practices by offering coverage for weather-related events like droughts, floods, or hailstorms. Additionally, the policies may provide financial incentives for farmers who adopt techniques that increase soil health, reduce water usage, or reduce emissions from fertilizers and machinery.

5. Supporting Climate Change Adaptation and Resilience

Green insurance products are playing a critical role in helping communities, businesses, and governments build resilience to climate change. These products cover risks related to extreme weather events, rising sea levels, and other climate-related disruptions.

- Resilience Insurance: Green insurance policies help businesses and governments prepare for climate change impacts by covering the costs of building resilience. This includes providing financial protection for infrastructure investments designed to withstand extreme weather events, such as flood defenses or hurricane-resistant buildings.

- Disaster Relief Coverage: Green insurance can also provide coverage for businesses affected by natural disasters, allowing them to recover and continue operating while reducing environmental impacts.

How Green Global Insurance Drives Economic Growth

The connection between green global insurance and economic growth is undeniable. By supporting sustainable development, fostering innovation, and enabling businesses to manage environmental risks, green insurance contributes to long-term economic stability.

1. Encouraging Investment in Green Technologies

Green insurance products encourage businesses to invest in clean technologies and renewable energy. By reducing the risks associated with these technologies, insurers enable businesses to take on innovative projects that may otherwise be deemed too risky. This drives investment in green technologies, which, in turn, stimulates economic growth in industries such as clean energy, electric vehicles, and sustainable construction.

2. Reducing Economic Losses from Climate Change

One of the most significant ways green global insurance contributes to economic growth is by reducing the financial losses caused by climate-related events. By offering coverage for environmental risks and climate-induced disasters, green insurance helps businesses recover from losses and resume operations, reducing the economic disruption caused by extreme weather events.

3. Incentivizing Corporate Responsibility

Green global insurance also encourages businesses to adopt corporate social responsibility (CSR) practices that benefit both the environment and the economy. Insurance companies are offering policies that reward companies for adopting sustainable practices, such as reducing waste, conserving energy, and minimizing their carbon footprint. These incentives not only promote environmental responsibility but also enhance a company’s reputation, making it more attractive to consumers and investors.

4. Creating Green Jobs and Economic Opportunities

The rise of green insurance is also creating new job opportunities. As demand for green technologies and sustainability increases, new industries and sectors emerge. Green insurance encourages businesses to invest in eco-friendly technologies and practices, which creates green jobs in sectors like renewable energy, sustainable construction, and environmental consulting. These jobs contribute to economic growth and help build a sustainable workforce for the future.

5. Boosting Public-Private Partnerships for Sustainability

Green global insurance also fosters public-private partnerships aimed at achieving sustainability goals. Governments are collaborating with insurers to create policies that promote environmental responsibility and drive economic growth. These partnerships can lead to investments in large-scale projects such as renewable energy infrastructure, green urban development, and disaster resilience programs.

The Challenges of Green Global Insurance

Despite its clear potential, green global insurance faces certain challenges that must be addressed for its continued growth and success.

1. Understanding and Quantifying Environmental Risks

One of the fundamental challenges for green global insurance is the difficulty in assessing and quantifying environmental risks. The unpredictability of extreme weather events and the increasing complexity of environmental damage make it difficult to establish accurate risk models. Insurers often have to rely on advanced data analytics, climate modeling, and environmental impact assessments to predict and cover environmental risks adequately.

2. Navigating Regulatory Challenges

There is a growing need for clear regulatory frameworks for green insurance products, especially when it comes to transparency and accountability. Without standard guidelines and rules in place, insurers may face difficulties in ensuring that their green policies meet the global environmental sustainability targets. Regulatory uncertainty can discourage investment in green insurance by companies and consumers alike.

3. Raising Consumer Awareness and Engagement

While green global insurance is gaining traction, many consumers are still unfamiliar with how it works and its potential benefits. Insurance companies must undertake substantial efforts to educate consumers about the advantages of green insurance policies, their role in sustainability, and the economic incentives available. Raising awareness will be essential to encourage widespread adoption of green insurance.

4. Availability of Green Insurance Products

Another challenge is the limited availability of green insurance products, especially in emerging markets where the awareness of sustainability may not be as prevalent. In these regions, it may be harder to integrate green insurance products into the existing infrastructure due to factors like high costs or limited access to insurance providers offering green solutions.

How Green Insurance Contributes to Long-Term Economic Stability

The long-term benefits of green insurance are felt not only in the immediate reduction of climate risks but also in fostering a broader framework for economic stability and growth. Here’s how:

1. Promoting Business Continuity and Risk Management

Green insurance policies offer businesses much-needed financial protection against climate risks, allowing them to continue operations even after catastrophic environmental events. By doing so, insurers contribute to business continuity and economic resilience, ensuring that companies are not set back by extreme weather events, floods, or fire damage.

2. Unlocking Capital for Green Innovation

As businesses implement green technologies and practices, green insurance helps unlock capital for innovation. This is particularly true in sectors such as clean energy, electric vehicles, and sustainable construction. By providing risk management tools for companies developing new technologies, green insurance enables greater investment in innovation, which is key to driving both economic and environmental progress.

3. Encouraging Corporate Green Investments

Green insurance is also helping to direct capital flows toward environmentally responsible projects. As investors become increasingly concerned with sustainability, companies with green insurance are viewed as less risky, which makes them more attractive to investors. This promotes a cycle of green investment, leading to economic growth and the advancement of sustainable solutions.

The Green Insurance Model: A Deeper Look at Its Principles

To truly understand the impact of green global insurance, we must first delve deeper into the underlying principles that make it a transformative force in both environmental sustainability and economic growth.

At its core, green insurance promotes practices that are in line with sustainability goals—from reducing carbon footprints and managing natural resources wisely to improving energy efficiency. This sector encourages businesses and individuals to adopt green practices by integrating these into the risks they are covered for. The broader purpose behind green insurance is not merely to reduce risk but to stimulate positive change in the world’s environmental and economic landscapes.

Green Global Insurance and the Low-Carbon Transition

A central challenge facing the world today is the transition to a low-carbon economy. Insurance companies that offer green products are at the forefront of this transition by helping businesses and consumers adapt to the financial demands of reducing their carbon emissions.

- Carbon Neutral Insurance Solutions: Green insurance products can offset carbon emissions generated by insured activities by funding green projects. Some insurers even calculate the carbon footprint of insured individuals or businesses and offer them carbon-offset options to neutralize their environmental impact.

- Supporting Green Financial Markets: As businesses become more attuned to environmental concerns, green insurance products not only reflect an eco-conscious approach but are also fostering the growth of green financial markets. These insurance policies are frequently tied to green bonds, carbon credits, and other environmentally-focused financial instruments that further contribute to sustainability goals.

The Interconnectedness of Green Insurance and Sustainable Economic Growth

The relationship between green global insurance and economic growth is particularly evident when we look at how insurance companies are adapting to the risks posed by climate change. By offering insurance products that manage risks such as property damage due to extreme weather events or floods, insurers help businesses mitigate these externalities. This, in turn, creates a stable economic environment that can continue to thrive even in the face of climate change challenges.

Green insurance products also influence the economic behavior of businesses by rewarding those who demonstrate environmental responsibility. For instance, businesses adopting energy-efficient technologies or engaging in sustainable practices (such as water conservation and waste reduction) can access reduced premiums, translating into immediate financial savings and long-term profitability.

Resilient Communities and Sustainable Development

Green insurance plays a pivotal role in ensuring communities remain resilient in the face of climate risks. Through tailored policies, governments, businesses, and individuals are incentivized to invest in measures that protect communities against climate change impacts—such as floods, wildfires, and rising sea levels.

- Insurance for Sustainable Infrastructure: Building infrastructure that is both resilient and sustainable is crucial in the fight against climate change. Green insurance is helping fund the construction of flood defenses, energy-efficient buildings, and sustainable public transportation systems. This creates an economic cycle where the insurance sector supports the physical infrastructure that helps mitigate climate risks, driving both environmental and economic benefits.

- Boosting Sustainable Cities: Urbanization and population growth put immense pressure on natural resources. Green insurance contributes to sustainable urban development by covering projects focused on green infrastructure, such as urban green spaces, sustainable transport systems, and water management projects. By investing in cities that are both climate-resilient and eco-friendly, insurers help communities minimize their environmental impact, reduce economic loss, and improve living standards.

How Green Insurance Contributes to Long-Term Economic Stability

The long-term benefits of green insurance are felt not only in the immediate reduction of climate risks but also in fostering a broader framework for economic stability and growth. Here’s how:

1. Promoting Business Continuity and Risk Management

Green insurance policies offer businesses much-needed financial protection against climate risks, allowing them to continue operations even after catastrophic environmental events. By doing so, insurers contribute to business continuity and economic resilience, ensuring that companies are not set back by extreme weather events, floods, or fire damage.

2. Unlocking Capital for Green Innovation

As businesses implement green technologies and practices, green insurance helps unlock capital for innovation. This is particularly true in sectors such as clean energy, electric vehicles, and sustainable construction. By providing risk management tools for companies developing new technologies, green insurance enables greater investment in innovation, which is key to driving both economic and environmental progress.

3. Encouraging Corporate Green Investments

Green insurance is also helping to direct capital flows toward environmentally responsible projects. As investors become increasingly concerned with sustainability, companies with green insurance are viewed as less risky, which makes them more attractive to investors. This promotes a cycle of green investment, leading to economic growth and the advancement of sustainable solutions.

Also Read: What Is Green Insurance And How Does It Benefit The Environment?

Conclusion

Green global insurance is more than just a financial product; it is a powerful tool for driving both environmental change and economic growth. By incentivizing sustainable practices, promoting renewable energy, and supporting climate resilience, green insurance plays a pivotal role in helping individuals, businesses, and governments navigate the challenges posed by climate change. As the world continues to grapple with environmental issues, green insurance will remain an essential part of the solution, helping foster a more sustainable and resilient global economy.

FAQs

What is green global insurance?

Green global insurance refers to insurance products that encourage environmentally sustainable practices and help mitigate the risks associated with climate change and environmental damage.

How does green insurance benefit the environment?

Green insurance incentivizes sustainable practices, such as renewable energy adoption, energy-efficient building construction, and the reduction of carbon footprints, contributing to environmental protection.

Can I get discounts for using electric vehicles?

Yes, many green insurance policies offer discounts for owning electric or hybrid vehicles as part of efforts to reduce emissions.

Is green global insurance more expensive than traditional insurance?

Green insurance products can sometimes be more affordable due to the reduced environmental risk and the financial incentives offered to eco-conscious policyholders.

How does green insurance support renewable energy?

Green insurance provides coverage for renewable energy projects like solar, wind, and hydroelectric systems, helping mitigate risks and encouraging further investment in clean energy.

Does green insurance apply to homes and businesses?

Yes, green insurance policies are available for both residential properties and businesses that adopt sustainable practices such as energy-efficient designs or renewable energy systems.

Can green insurance help with climate change adaptation?

Yes, green insurance policies help businesses and governments prepare for climate change impacts by covering costs associated with building climate-resilient infrastructure and managing climate-related risks.