Disaster Insurance

affordable flood insurance, commercial flood insurance, comprehensive flood insurance, emergency flood insurance, FEMA flood insurance, flood coverage, flood damage coverage, flood damage protection, flood hazard, flood insurance, flood insurance benefits, flood insurance claims, flood insurance cost, flood insurance policy, flood insurance premium, flood insurance provider, flood insurance quote, flood insurance rates, flood insurance requirements, flood mitigation, flood policy, flood protection, flood risk, flood zone coverage, flood zone insurance, home flood insurance, national flood insurance, private flood insurance, residential flood insurance

mahainsurance

0 Comments

How Do You Choose The Best Flood Insurance Policy?

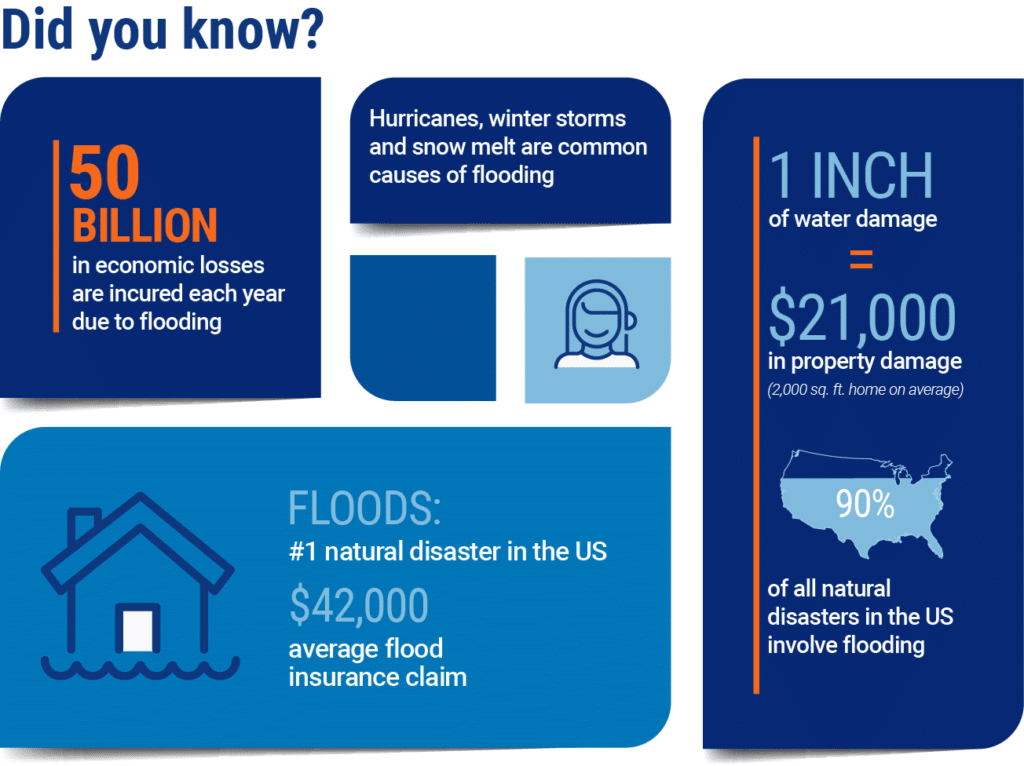

Flooding can occur anywhere, from coastal areas to inland regions, and it can devastate homes and businesses in its path. The unpredictable nature of floods makes them one of the most concerning natural disasters, and one that can leave victims financially crippled. While most homeowners’ insurance policies do not cover flood damage, flood insurance can offer crucial protection. However, with various policies available, selecting the right one can be overwhelming.

Key Takeaways

Be Prepared: Flood insurance often has a waiting period, so don’t wait until a flood is imminent to buy it.

Understand Your Risk: Assess your flood risk to determine the amount of coverage you need.

Know Your Coverage: Be clear about what is covered under your policy, including exclusions.

Compare Policies: Shop around to find the best policy in terms of coverage, premiums, and terms.

Consider Premiums and Deductibles: Choose a policy that fits your budget, but be mindful of the deductible.

Why Do You Need Flood Insurance?

Before delving into the specifics of choosing the best flood insurance policy, it’s important to understand why having this type of coverage is essential:

| Reason | Impact of Not Having Flood Insurance |

|---|---|

| Floods Can Happen Anywhere | Without coverage, you would bear full repair costs from unexpected floods. |

| Protection Against Property Loss | You risk high expenses to repair or replace your home and belongings. |

| Homeowners Insurance Excludes Floods | Without flood insurance, your standard policy won’t cover flood damages. |

| Rising Flood Risks | Increased risks from climate change can lead to more severe flooding, leaving you unprotected. |

| Protection for Businesses | Businesses could face costly repairs and operational disruptions without insurance. |

| Limited Government Assistance | Federal aid may not cover all damages or be available in time to help. |

| Peace of Mind | Without flood insurance, you face financial uncertainty and stress. |

| FEMA Requirements | If in a high-risk area, flood insurance may be required by your mortgage lender. |

| Community Recovery | Lack of insurance can slow down recovery and impact property values in your neighborhood. |

- Flood Risk: Flooding can happen anywhere, whether or not you live in a flood-prone area. Heavy rainfall, dam failures, storm surges, and even rapid snowmelt can lead to flooding in areas that may not be considered high-risk zones.

- Lack of Coverage: Standard homeowners’ insurance policies do not cover flood damage. You will need separate flood insurance to protect your home from flooding.

- Financial Protection: Floods can cause significant damage to homes, furniture, and personal belongings. Having flood insurance ensures that you have the financial resources to repair and replace your property.

- Government Assistance: In many cases, the Federal Emergency Management Agency (FEMA) provides flood relief, but this assistance may not be enough to cover all the damage. Flood insurance ensures that you have a safety net when disaster strikes.

Types of Flood Insurance Policies

There are two main types of flood insurance: National Flood Insurance Program (NFIP) policies and private flood insurance policies. Let’s take a closer look at each:

National Flood Insurance Program (NFIP) Policies

The NFIP is a government-run program administered by FEMA that provides flood insurance to property owners in participating communities. It offers two types of coverage:

- Building Property Coverage: This covers the physical structure of your home, including the foundation, walls, floors, and essential appliances like air conditioning units. It may also include garages or basements, but there are limitations on what is covered.

- Personal Property Coverage: This covers your personal belongings, including furniture, clothing, electronics, and appliances. This coverage applies even if the items are located on the ground floor or in a basement.

NFIP policies are typically easier to obtain since they are backed by the federal government, and they tend to have standardized coverage options. However, NFIP policies may have lower coverage limits and may not fully cover the total cost of rebuilding or replacing damaged property, depending on the severity of the flood.

Private Flood Insurance Policies

Private flood insurance policies are offered by private insurance companies and are not subject to the limitations imposed by the NFIP. These policies tend to offer more flexibility, customized coverage, and higher limits. They may also cover more types of property, such as luxury items or certain types of personal property not covered under an NFIP policy.

Private flood insurance can be beneficial for high-risk areas where NFIP coverage may not be sufficient. However, private insurers may require additional paperwork, and the premiums may vary based on the specific flood risk of the property.

Key Considerations When Choosing a Flood Insurance Policy

Choosing the right flood insurance policy involves several key considerations. Below, we discuss the most important factors to keep in mind.

1. Understand Your Flood Risk

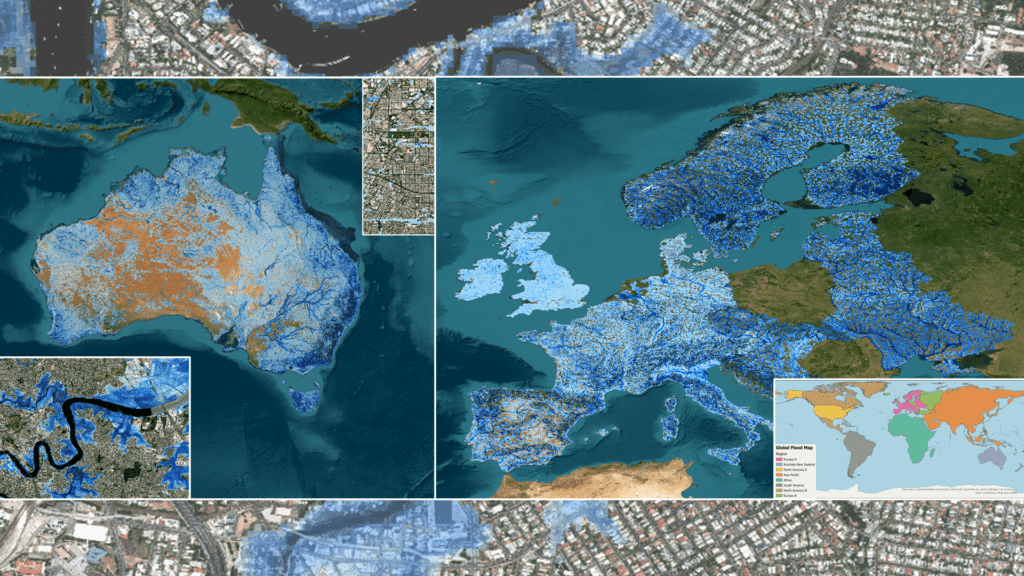

Your flood risk is the most important factor in determining the coverage you need. FEMA provides flood maps that categorize areas based on flood risk (high, moderate, or low). High-risk areas, such as zones designated as Special Flood Hazard Areas (SFHAs), have the highest risk of flooding. Properties located in these zones are typically required to carry flood insurance, especially if they have a mortgage backed by the federal government.

However, it’s important to note that flooding can occur anywhere, even in low- or moderate-risk areas. Assessing your flood risk can help you determine how much coverage you need.

2. Coverage Limits

Flood insurance policies have coverage limits that specify the maximum amount the insurance company will pay in the event of a flood. NFIP policies offer a maximum coverage of $250,000 for the structure of your home and $100,000 for personal property. For private flood insurance policies, coverage limits can be much higher, but they will depend on the insurer and the specifics of the property.

When choosing a flood insurance policy, consider the following:

- How much would it cost to rebuild your home? The coverage should be sufficient to cover the cost of repairs or rebuilding in the event of a major flood.

- Are your personal belongings adequately covered? You’ll need to ensure that the policy covers the replacement cost of your personal belongings, including high-value items such as electronics and furniture.

- Consider additional coverage for expensive items like jewelry, artwork, and collectibles, as these may not be covered under standard policies.

3. Exclusions and Coverage Details

Flood insurance policies typically exclude certain types of property or damage. For example:

- Basement Coverage: Many NFIP policies limit basement coverage to structural elements, such as walls and floors. Personal belongings or appliances in basements are often excluded unless you purchase additional coverage.

- Landscaping and Outdoor Property: Outdoor structures like sheds, fences, or landscaping may not be covered by either NFIP or private flood insurance policies.

- Temporary Housing: Some flood insurance policies may provide coverage for temporary living expenses if your home becomes uninhabitable due to flooding, but not all policies offer this.

Make sure to review the exclusions carefully before selecting a policy to avoid unpleasant surprises when filing a claim.

4. Premiums and Deductibles

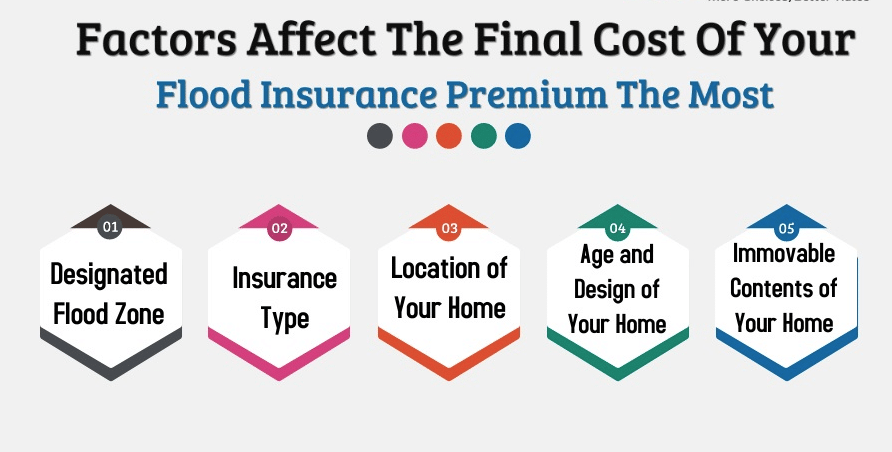

Flood insurance premiums can vary greatly depending on factors like your location, the value of your home, and the level of coverage you choose. NFIP policies tend to have lower premiums compared to private insurance policies, but this comes with the trade-off of lower coverage limits and fewer customization options.

A higher deductible can lower your premiums but will increase your out-of-pocket expenses in the event of a claim. Consider your budget and the financial risk you’re willing to accept when deciding on your deductible.

5. Waiting Period

NFIP policies typically have a 30-day waiting period before the coverage takes effect, so it’s important to purchase flood insurance well in advance of any anticipated flood event. Private insurance companies may have shorter waiting periods, but this varies by provider.

6. Compare Policies

It’s essential to compare different policies before making a decision. While NFIP coverage is more standardized, private flood insurance policies may offer more customized options, such as additional coverage for specific items or reduced waiting periods. Shop around and compare premiums, coverage limits, exclusions, and policy details to find the best fit for your needs.

7. Understand Claims Process

Before purchasing flood insurance, understand the claims process. How quickly can you expect to receive compensation after a flood event? How easy is it to file a claim? Having a clear understanding of the claims process ensures that you’re prepared if disaster strikes.

8. Consider Long-Term Flood Risk Projections

One of the most important things to understand when choosing flood insurance is how flood risk may evolve over time. Flood maps and risk assessments are not static; they are subject to changes due to environmental shifts such as climate change, land development, or changes in water management systems.

For example:

- Sea-Level Rise: Rising sea levels due to climate change have already contributed to the increased frequency of coastal flooding. Even properties that were previously in low-risk areas may experience a heightened risk of flooding in the future.

- Urbanization: As more buildings are constructed, natural water flow can be obstructed, leading to an increased risk of flooding in urban areas. This phenomenon, known as “urban flooding,” is on the rise, and it may affect areas that once had little to no flood risk.

- Natural Changes: Rivers and lakes can shift their courses or overflow due to changes in weather patterns, potentially increasing the likelihood of floods in areas that were once considered safe.

This means that a flood insurance policy you buy today may need to be reevaluated in the future to ensure it still provides adequate coverage as your flood risk evolves.

9. The Role of Flood Zones and Flood Maps

Flood zones play a significant role in determining the cost and coverage of your flood insurance policy. The Federal Emergency Management Agency (FEMA) issues flood maps, which categorize areas based on their likelihood of experiencing a flood in any given year. These maps are divided into different flood zones, including:

- Special Flood Hazard Areas (SFHAs): These are areas with a high probability of flooding (more than 1% chance annually). Properties in these zones are more likely to be required to carry flood insurance.

- Moderate to Low-Risk Areas: While these zones have a lower risk of flooding, they are not entirely safe from the possibility of flooding. As a result, homeowners in these zones may choose to purchase flood insurance to protect their assets at an affordable rate.

- Undetermined Risk Zones: These zones are not formally categorized by FEMA, and the risk of flooding is unknown. Homeowners in these areas can still obtain flood insurance through the NFIP or private insurers.

Before purchasing flood insurance, it’s important to identify your home’s specific flood zone. This can give you a sense of the likelihood of flooding in your area, and whether flood insurance is mandatory or optional. It’s also essential to stay informed about updates to flood maps, as your property’s risk classification may change over time.

10. Factors That Affect the Cost of Flood Insurance

The cost of flood insurance can vary dramatically based on several factors, some of which are beyond your control, while others are more easily adjustable. These factors include:

- Location: The proximity of your home to a water source (river, ocean, lake, etc.) plays a major role in determining your premiums. If you live in a flood-prone area or an SFHA, your premiums are likely to be higher.

- Elevation: Properties that are elevated above the base flood elevation (BFE) will usually have lower insurance premiums. Homes with a higher elevation are less likely to experience flood damage.

- Age and Condition of the Home: Older homes, particularly those that have not been updated with modern flood-proofing techniques, are more likely to suffer damage from floods. As such, older homes may have higher premiums.

- Coverage Limits and Deductibles: The more coverage you purchase, the higher your premium will be. Similarly, lower deductibles often mean higher premiums. Balancing your premium with a deductible that suits your financial situation is key.

- Mitigation Measures: Some insurance companies offer discounts for properties that have undergone flood mitigation measures, such as installing sump pumps, elevating electrical systems, or adding flood barriers. Taking proactive steps to reduce flood risk can lower your premium.

11. Flood Insurance for Business Properties

Flood insurance is not limited to homeowners; it’s also crucial for businesses, especially those located in high-risk flood zones. Business owners face the risk of significant property damage, inventory loss, and disruption to operations in the event of a flood. Unfortunately, many standard commercial property insurance policies do not include flood coverage.

Business owners can opt for commercial flood insurance policies, which are offered either through the NFIP or private insurers. These policies typically cover:

- Physical Structure: Like residential policies, commercial flood insurance covers the building structure, including foundations, walls, and roofs.

- Inventory and Equipment: Coverage may extend to the loss of inventory, office equipment, and machinery, depending on the terms of the policy.

- Business Interruption: Some policies offer business interruption coverage, which helps to cover lost income and expenses incurred due to flood damage.

Just like homeowners, business owners must assess their flood risk and evaluate the coverage limits that best protect their business from potential flooding.

12. How to File a Flood Insurance Claim

In the unfortunate event that your property suffers flood damage, knowing how to file a flood insurance claim is crucial. Here is a general process for filing a claim:

- Contact Your Insurance Provider: Notify your flood insurance provider as soon as possible to report the damage. Be sure to have your policy number on hand and provide details of the event.

- Document the Damage: Take photos and videos of all damage to your property, including the building and personal property. Document any floodwaters that have entered your home or business. This evidence will be critical for your claim.

- File Your Claim: Submit your claim to your insurance provider along with any supporting documentation. Some insurers may require you to submit a Proof of Loss form within 60 days of the flood.

- Inspection: A claims adjuster may visit your property to assess the extent of the damage. Be sure to make your home accessible for this inspection.

- Settlement: After the assessment, the insurance company will provide a settlement based on the terms of your policy. If the settlement doesn’t fully cover the damage, you can appeal the decision or seek additional coverage.

13. The Benefits of Flood Insurance Beyond Financial Protection

Flood insurance provides more than just financial protection for homeowners and businesses. Here are some additional benefits:

- Peace of Mind: Knowing that you have flood insurance in place gives you peace of mind in the event of a natural disaster. You can rest easy knowing that you have the resources to repair your home or business if necessary.

- Encourages Preparedness: Purchasing flood insurance often encourages homeowners and businesses to take proactive measures to reduce flood risk. This might include elevating structures, installing sump pumps, or reinforcing windows and doors.

- Government Assistance: In some cases, having flood insurance can make it easier to qualify for federal aid or disaster relief in the event of widespread flooding, as some forms of government assistance may require proof of insurance coverage.

Conclusion

Choosing the right flood insurance policy is essential for protecting your home and belongings from the devastation caused by floods. Whether you choose an NFIP policy or a private flood insurance policy, make sure to carefully consider factors like your flood risk, coverage limits, exclusions, premiums, and deductibles. By taking the time to compare different policies and understanding the details of each, you can ensure that you select the best flood insurance policy for your needs.

Frequently Asked Questions (FAQs)

1. Does flood insurance cover storm surges?

Yes, flood insurance covers storm surges, which are caused by the rise in water level due to strong winds and pressure changes during a storm. However, it’s essential to review the specifics of your policy to ensure full coverage for such events.

2. Can I buy flood insurance if I don’t live in a high-risk area?

Yes, flood insurance is available to homeowners in low- and moderate-risk areas as well. It’s highly recommended, as flooding can happen anywhere.

3. How do I file a flood insurance claim?

To file a flood insurance claim, contact your insurance provider as soon as possible after the flood. Document the damage with photographs or videos, and provide all necessary information requested by the insurer.

4. How much does flood insurance cost?

The cost of flood insurance varies depending on several factors, including the location, the value of the property, the level of coverage, and the type of policy. On average, premiums for NFIP policies are lower than those for private flood insurance.

5. Can I get flood insurance if I have a mortgage?

Yes, if you live in a high-risk flood zone, your lender may require you to have flood insurance. Even if you don’t live in a high-risk area, you can still purchase flood insurance for added protection.

6. What is the maximum coverage for flood insurance?

The maximum coverage for an NFIP policy is $250,000 for the building and $100,000 for personal property. Private flood insurance policies may offer higher limits depending on the insurer.

7. Does flood insurance cover damage to personal vehicles?

No, flood insurance typically does not cover personal vehicles. However, if you have comprehensive auto insurance, it may cover vehicle damage from flooding.